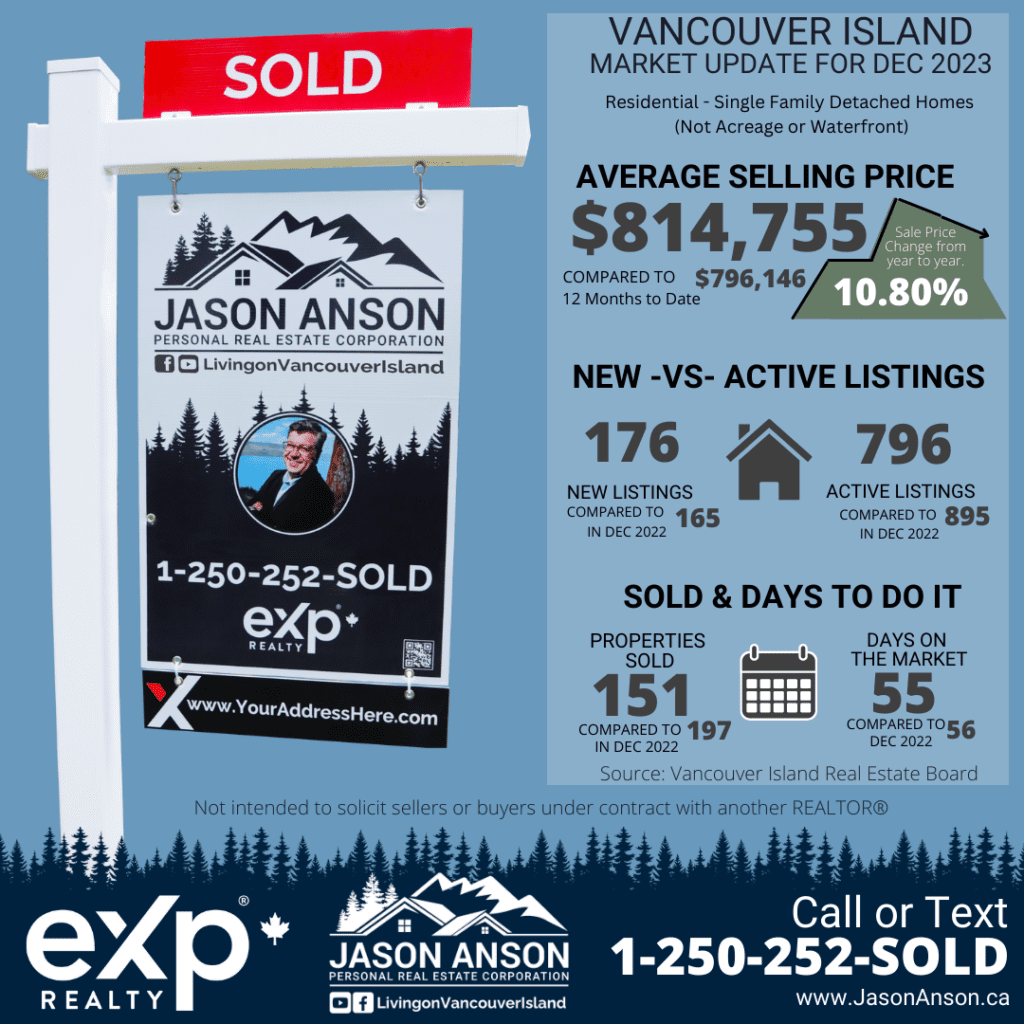

- Units Listed: There has been a slight increase in units listed this month compared to last year, with a 6.67% rise. However, looking at the year-to-date figures, there is a noticeable reduction in new listings by 17.14%. This decline might indicate a tightening market where fewer homeowners are willing to sell, possibly due to market uncertainties or holding out for better pricing conditions.

- Units Reported Sold: The sales volume has decreased by 23.35% compared to last December and by 7.66% year to date. This downturn in sales could be reflective of various factors such as affordability concerns, rising interest rates, or a wait-and-see approach from buyers.

- Sell/List Ratio: The sell/list ratio has decreased significantly from last year, from 119.39% to 85.80% this month, indicating a shift towards a more balanced or even buyer’s market. The ratio’s decrease year-to-date further corroborates this trend.

- Reported Sales Dollars: There is a marked decrease of 15.07% in sales dollars this month compared to the previous year and a 12.98% decrease year to date. This decline could be due to fewer transactions or a market shift toward lower-priced properties.

- Average Sell Price/Unit: Interestingly, the average selling price per unit has increased by 10.80% compared to last December, yet there’s been a decrease of 5.76% year to date. This increase in the monthly average sell price could be due to a number of higher-value transactions or a temporary market anomaly.

- Median Sell Price: The median sell price remains stable at $765,000. This stability is a good sign, indicating a consistent market value for properties in the median range.

- Sell Price/List Price Ratio: There’s a slight decrease in the sell price to list price ratio, indicating that homes are selling for slightly less relative to their listing prices than in the previous year. This might be due to buyers negotiating harder or sellers pricing more aggressively to attract interest.

- Days to Sell: Homes are taking slightly less time to sell this month compared to last year, but significantly longer year to date. The longer time to sell might reflect buyers’ hesitancy or more extensive selection in the market.

- Active Listings: The number of active listings is lower than last year, indicating a tighter market. Fewer active listings can lead to increased competition among buyers, potentially stabilizing or increasing prices, particularly if demand remains consistent.

Interpretation and Implications:

- Market Cooling and Shifts: The overall data suggests a market that’s cooling down, with fewer transactions and a slight decrease in sell/list ratios.

- Price Dynamics: While average selling prices have seen an uptick this month, the year-to-date decrease suggests a broader downward trend in pricing or a market adjusting to various economic pressures.

- Buyer’s Market Indicators: The increase in days to sell and decrease in sell/list ratios suggest a shift towards a buyer’s market, where buyers might find more negotiating power.

- Inventory Challenges: The continued decrease in listings indicates a persistent inventory challenge. This could lead to increased competition and potentially stabilize or increase prices in the longer term if demand persists.

In conclusion, the market is exhibiting signs of cooling, with various factors influencing both seller and buyer behaviors. It’s crucial for potential sellers to understand these dynamics to price and market their homes effectively and for buyers to recognize the opportunities and challenges in the current market. A professional real estate agent’s role becomes increasingly important in navigating these complexities and facilitating successful transactions.

No responses yet