Will the Vancouver Island Real Estate Market Crash in 2024?

Online Vancouver Island Real Estate

Join these groups for lively discussions and my expert insights, helping you read between the market lines where algorithms don’t tread.

A collection of Vancouver Island Real Estate Listings, News and Market Reports.

Engage on Reddit about different Vancouver Island Real Estate topics such as listings, news and market reports.

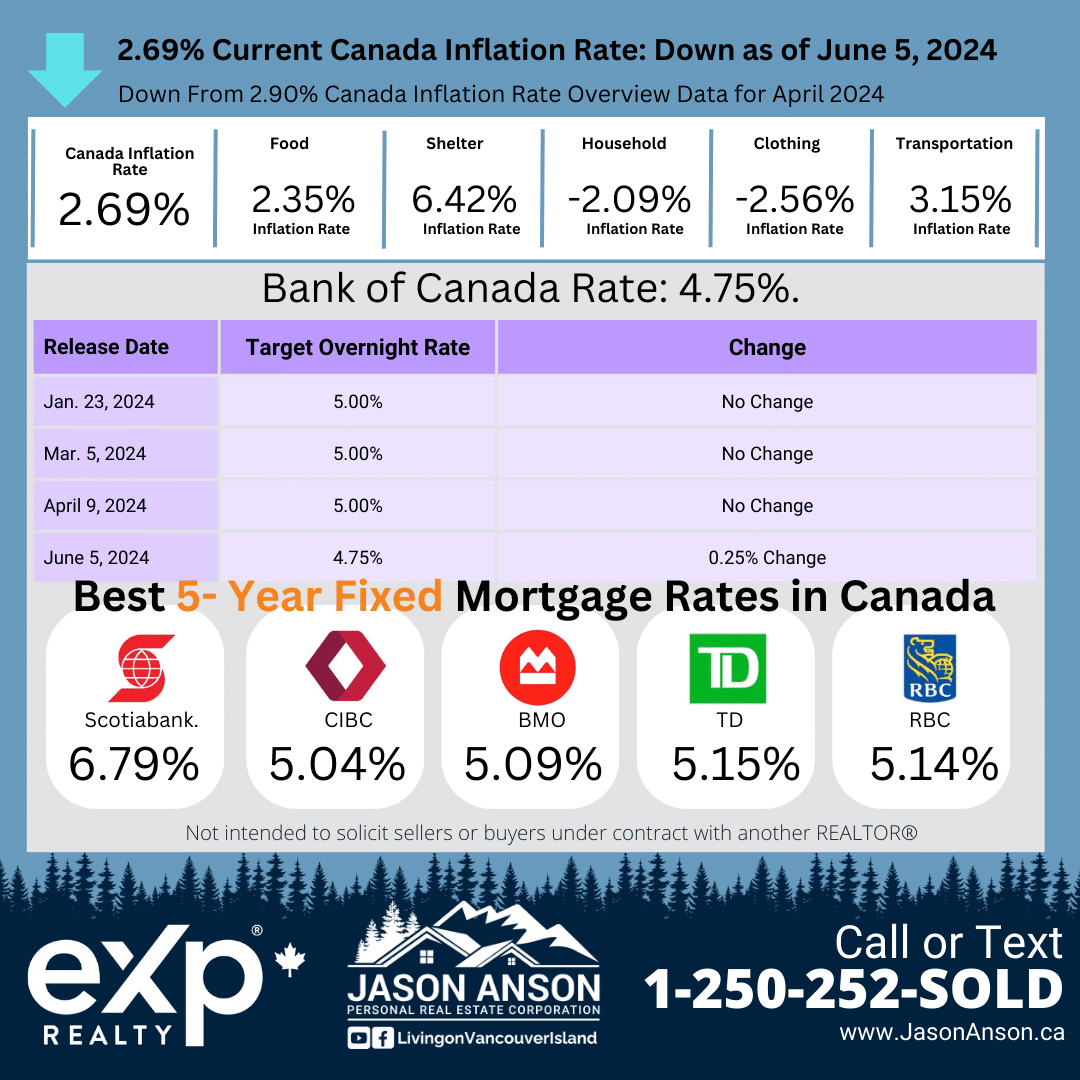

Economic Conditions

Bank of Canada Background

The Bank of Canada, established in 1934 under the Bank of Canada Act, serves as the nation’s central bank and a crown corporation. Its primary mission is to foster economic and financial stability across Canada. As the key architect of Canada’s monetary policy, the Bank of Canada plays a crucial role in overseeing the country’s financial systems. Its central mechanism for managing monetary policy is the target for the overnight rate, also known as the key policy rate. By adjusting this rate, the Bank influences the amount of money in circulation within the economy. Additionally, it holds the exclusive authority to issue and manage Canadian currency and regulate foreign currency reserves. As a realtor, understanding these policies can provide insights into market trends and financial conditions affecting the real estate sector.

The Bank of Canada and Mortgage Rates

As a realtor, it’s crucial to understand how the Bank of Canada impacts mortgage rates, a key factor affecting the housing market. The Bank sets the key policy rate, which influences all borrowing and lending rates in Canada, including the prime rates set by banks. When the Bank adjusts this rate, it directly affects variable mortgage rates, which are tied to the lender’s prime rate.

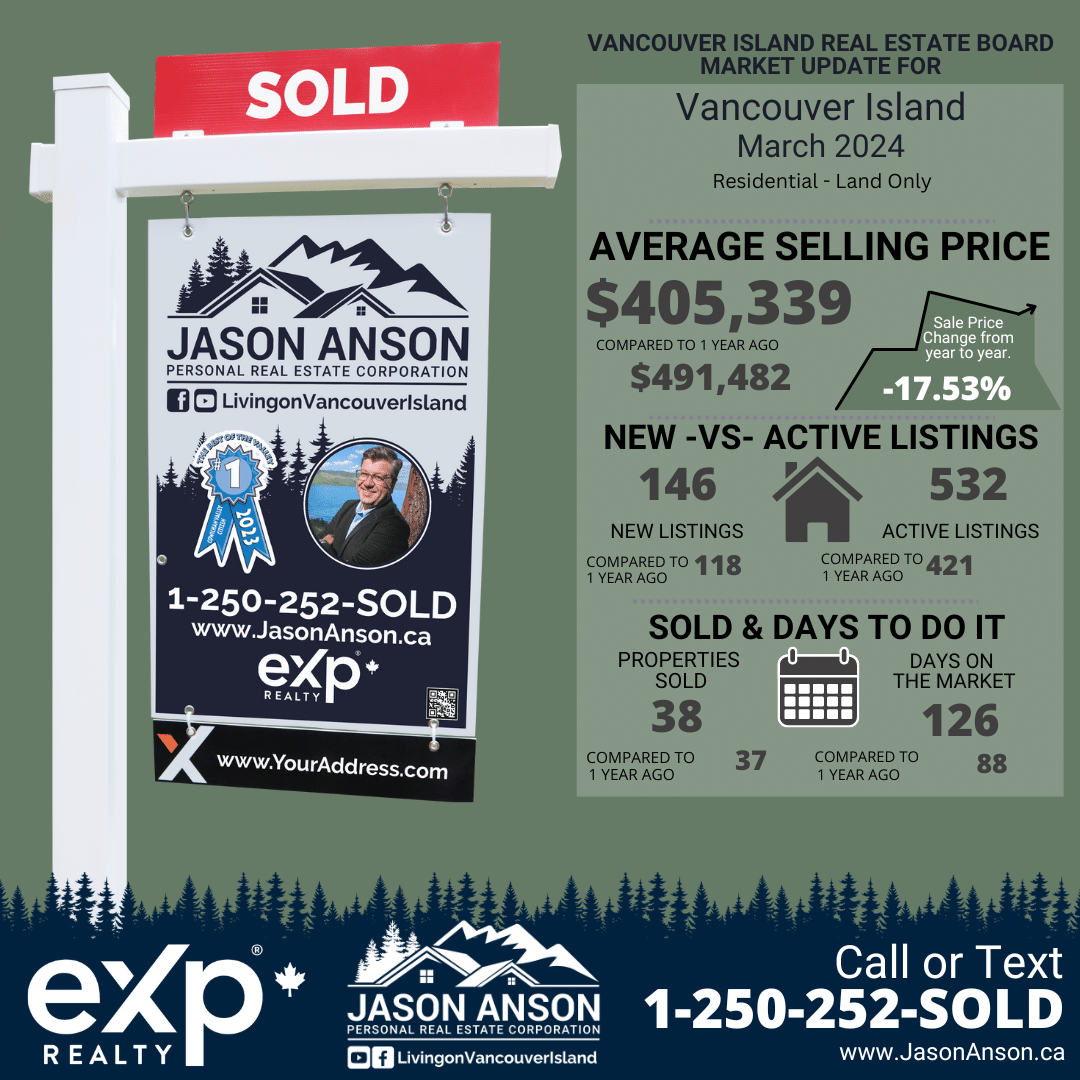

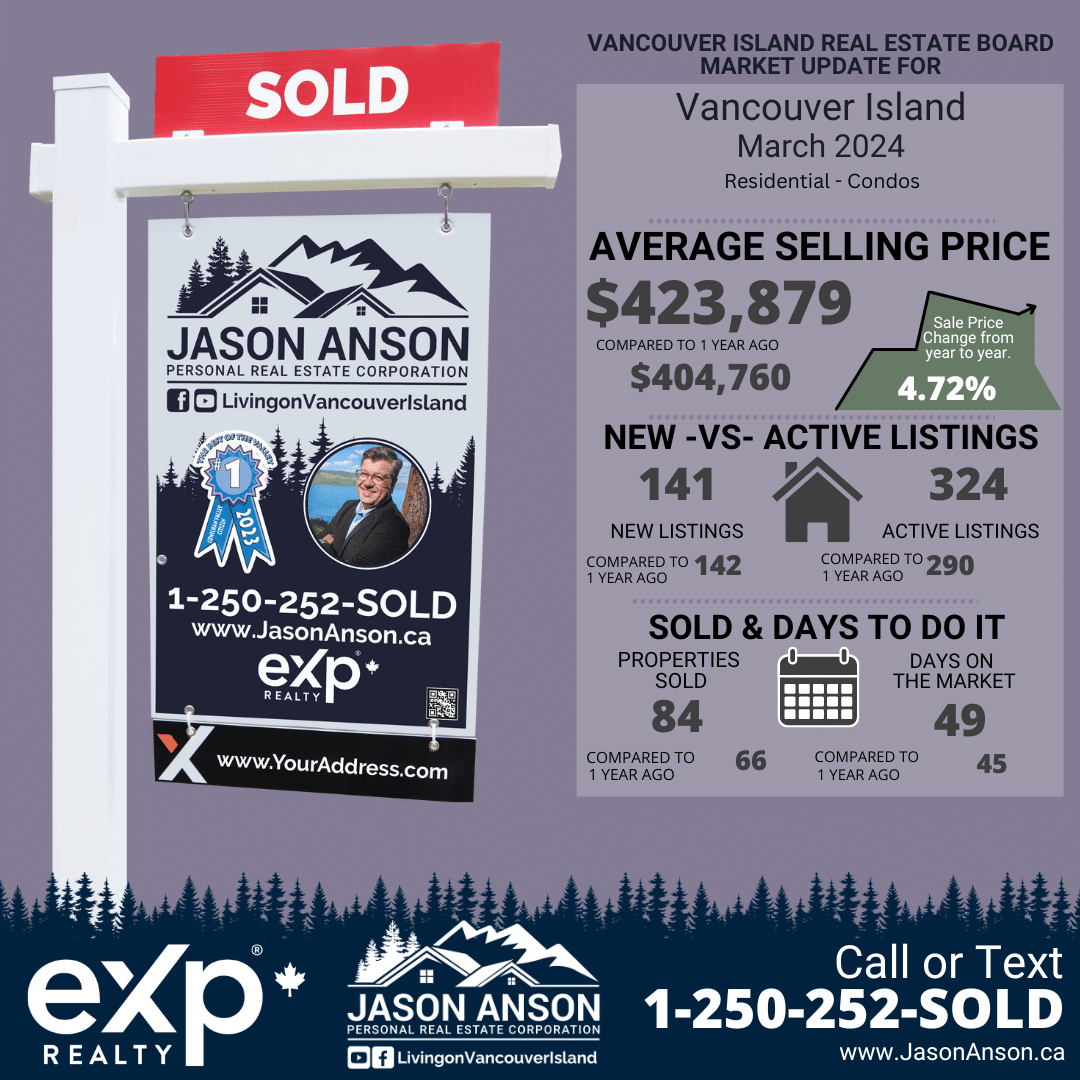

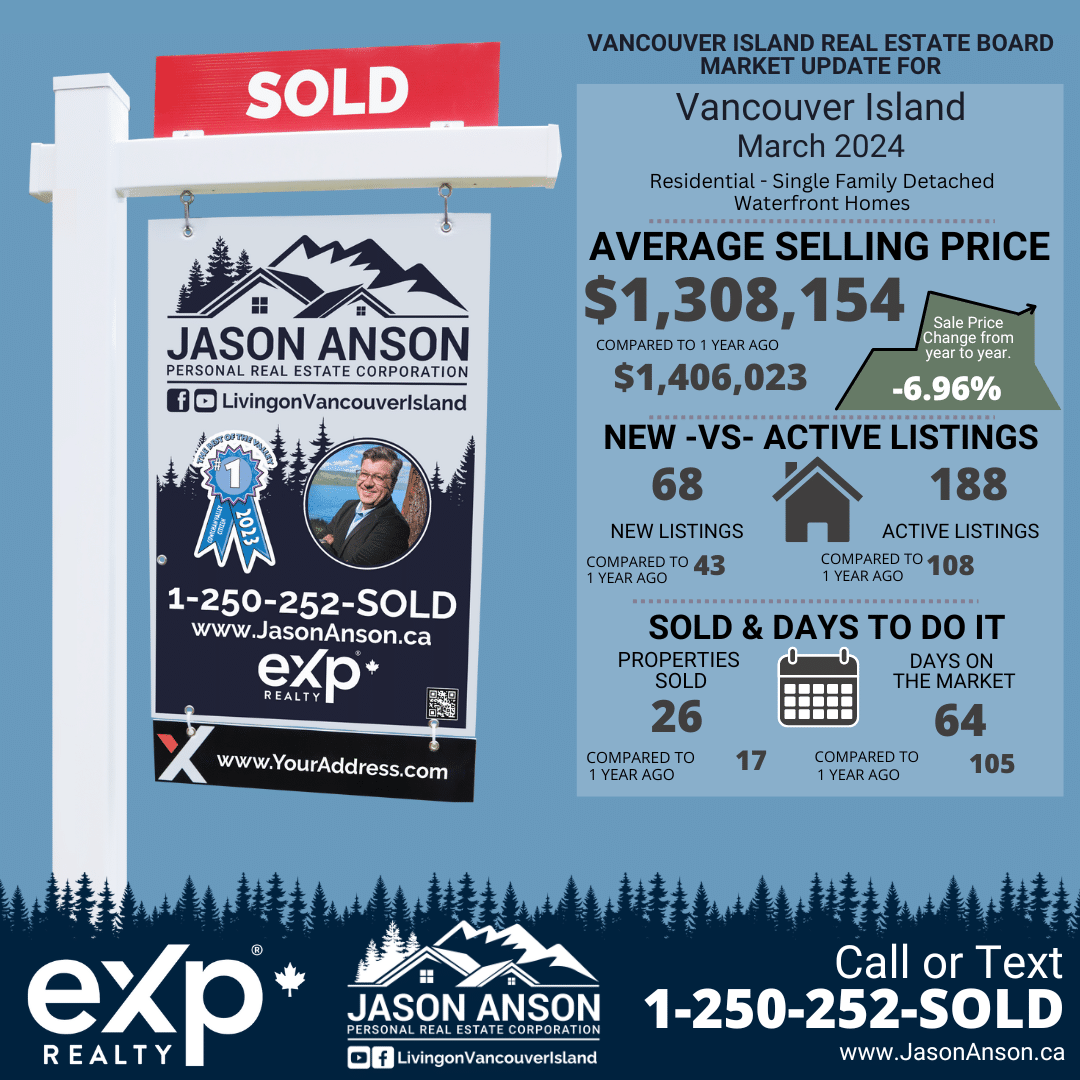

Supply and Demand

Understanding the Market’s Pulse

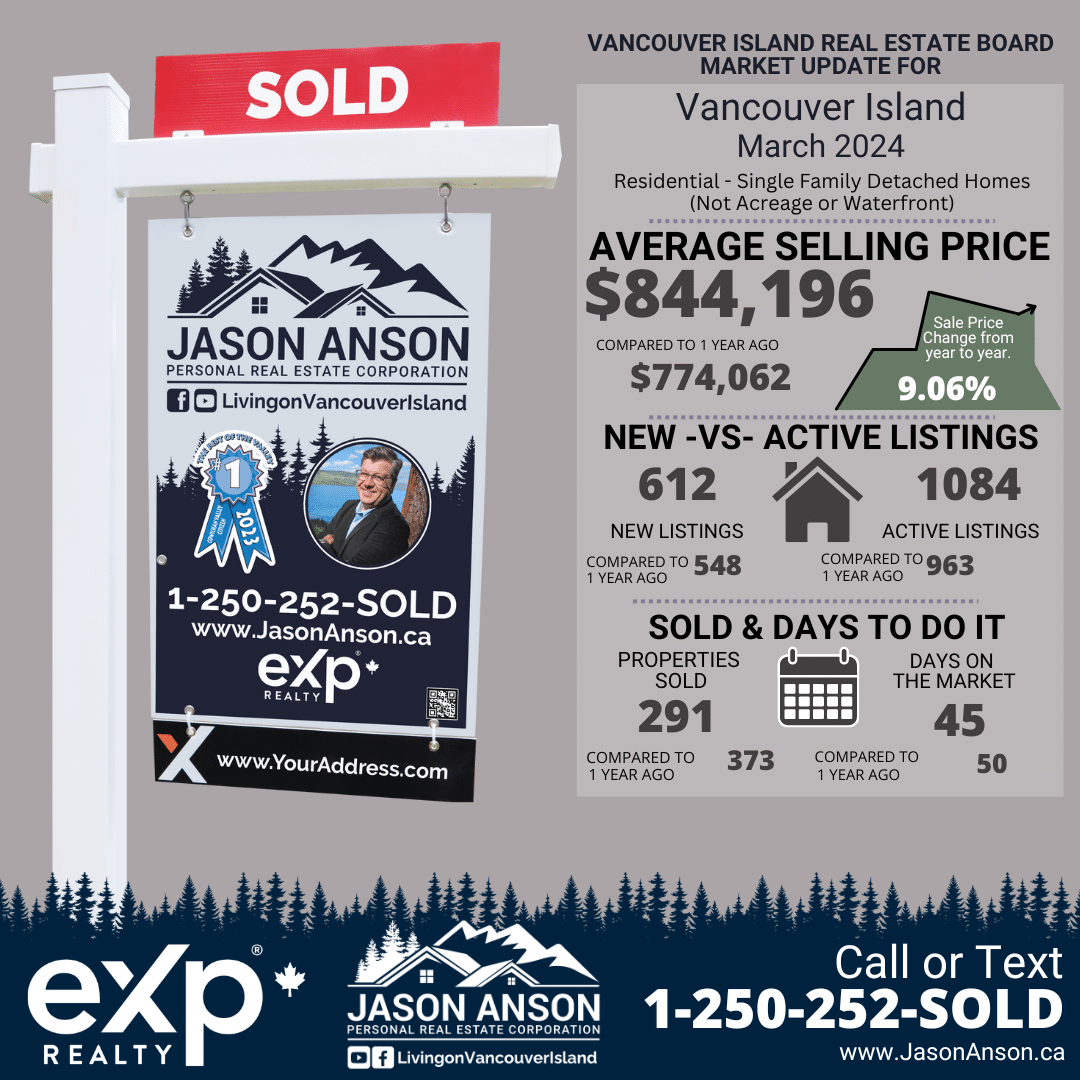

Vancouver Island Comparative Activity by Property Type