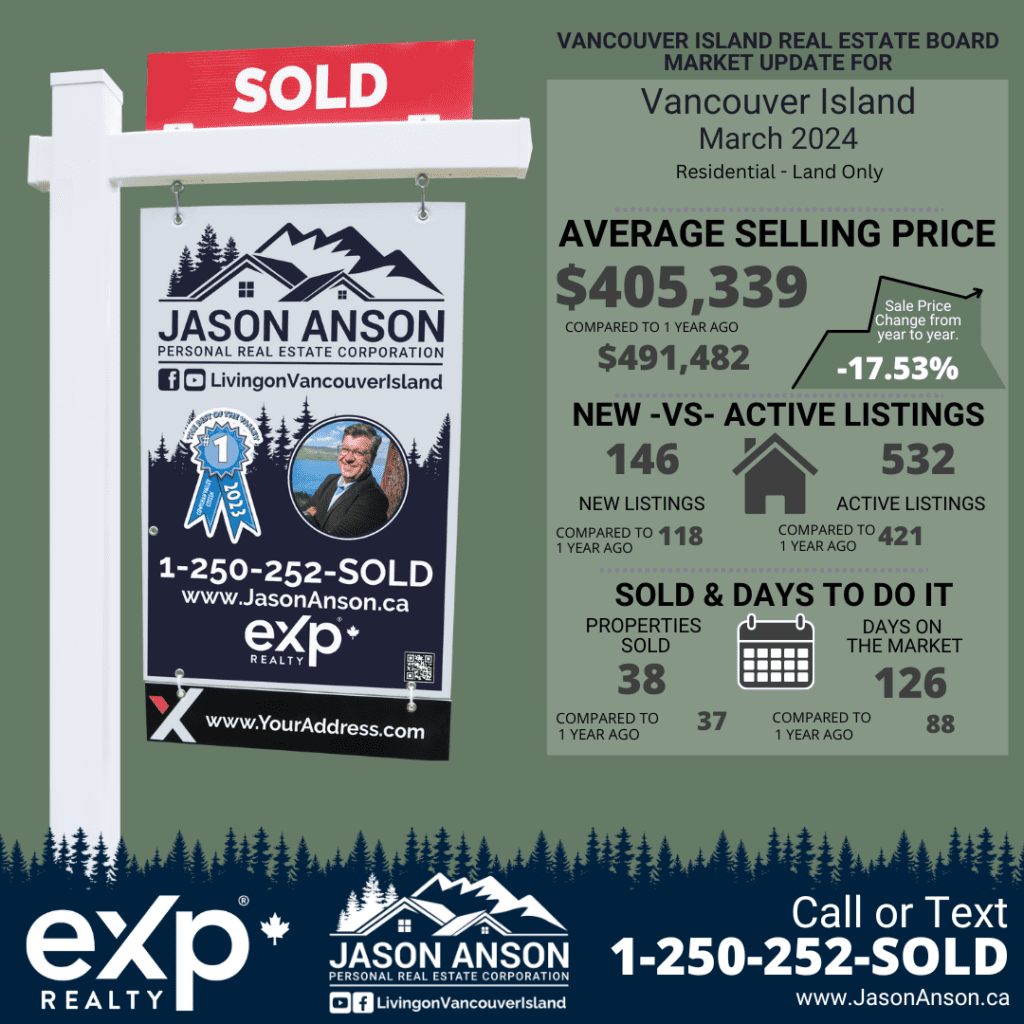

In this report, I delve into Vancouver Island Property Values for March 2024, specifically focusing on land transactions. Drawing from the latest data provided by the Vancouver Island Real Estate Board, we will scrutinize the current market conditions, including trends in listings, sales volumes, and pricing adjustments, to provide stakeholders with a thorough understanding of the land market’s trajectory this month.

Supply and Demand:

March 2024 observed a significant uptick in land listings on Vancouver Island, with units listed increasing by 23.73% compared to last year. This surge in listings suggests a growing market, yet the slight 2.70% increase in units reported sold indicates a more cautious buyer response. The sell/list ratio also saw a decrease from last year’s 31.36% to 26.03%, pointing to a cooling market dynamic. These trends highlight a divergence between supply and buyer readiness, potentially leading to price negotiations favoring buyers.

Vancouver Island Real Estate Market Overview for March 2024:

As we assess the health of the Vancouver Island land market this March, several factors come into play. Despite the increase in listings to 532 active listings from last year’s 421, the average sell price per unit saw a significant decrease of 17.53% year-over-year. This reduction in average prices, combined with a lengthening in days to sell—from 88 days last year to 126 days this year—indicates a market that is becoming increasingly buyer-friendly but poses challenges for sellers seeking timely transactions.

Detailed Analysis:

The detailed market analysis for March 2024 reveals that while there is an abundance of land listings, the actual sales performance is lagging slightly behind the supply. This is evidenced by the moderate increase in reported sales dollars despite the substantial rise in listings. The median sell price slightly dipped to $352,450 from last year’s $358,000, further confirming a shift towards buyer advantage in price negotiations.

Vancouver Island Real Estate Market Insight: Comparative Activity by Property Type for March 2024:

In March 2024, Vancouver Island’s land market saw diverse movements across key metrics:

- Units Listed: Increased by 23.73%, indicating a robust addition to the market inventory.

- Units Reported Sold: Marginal growth in sales, up by 2.70% from last year.

- Sell/List Ratio: A decline in the sell/list ratio highlights a less competitive market environment.

- Reported Sales Dollars: Despite a decrease in total sales dollars by 15.30% this month, there is a year-to-date increase of 13.58%.

- Average Sell Price/Unit: The average selling price saw a downturn, suggesting a market adjustment to the increased inventory.

- Median Sell Price: This year’s median sell price is slightly below the previous year’s, reflecting a buyer’s market.

- Sell Price/List Price Ratio: The ratio has seen slight improvements, although remaining under pressure.

- Days to Sell: The increase in days to sell underscores a slower market, necessitating patience from sellers.

- Active Listings: The rise in active listings by over 100 units from the previous year speaks to an expanded market that might pressure prices further.

Current Month Analysis:

- Units Listed: 146 units were listed, increasing by 23.73% from last year, indicating a growing inventory.

- Units Reported Sold: Slight growth with 38 units sold, up from 37 last year.

- Sell/List Ratio: Dropped to 26.03%, showing reduced market heat.

- Reported Sales Dollars: Fell to $15,402,900, a decrease of 15.30% from last year, reflecting lower transaction values.

- Average Sell Price/Unit: Decreased to $405,339, reflecting the downward pressure on prices.

- Median Sell Price: Stands at $352,450, slightly lower than last year.

- Sell Price/List Price Ratio: Improved slightly to 95.36%, yet still indicative of a buyer’s market.

- Days to Sell: Increased to 126 days, showing a slower pace of sales.

- Active Listings: Total active listings are now at 532, suggesting a larger pool of available properties.

12 Months to Date Analysis:

- Units Listed: Over the past 12 months, 1,250 units were listed, marking an 11.21% increase from the previous year. This sustained rise suggests a growing market, though it may reflect seller anticipation of favorable conditions.

- Units Reported Sold: Sales volume reached 349 units, a substantial 20.34% increase from the previous period. This increase could indicate robust demand despite broader market uncertainties.

- Sell/List Ratio: The year-to-date sell/list ratio stood at 25.80%, slightly higher than last year’s 24.12%, showing a marginally more competitive market compared to the broader trend.

- Reported Sales Dollars: The reported sales dollars amounted to $155,419,253, reflecting a 4.25% increase year over year, pointing to higher overall transaction values.

- Average Sell Price/Unit: The average selling price over the last 12 months was $445,327, down 13.38% from the previous year, aligning with the trend towards more buyer-friendly pricing.

- Median Sell Price: The median sell price for this period adjusted to $376,500, suggesting a moderate market position between the extremes of high and low sales.

- Sell Price/List Price Ratio: This ratio slightly improved to 95.59%, indicating that sellers are achieving closer to their asking prices.

- Days to Sell: Increased to 104 days on average, a significant rise, reflecting a slower market that could be challenging for sellers seeking quick sales.

- Active Listings: The trend in active listings rose over the year, supporting the narrative of a market with increasing inventory.

Year to Date Analysis:

- Units Listed: Year-to-date listings reached 340, up 25.46% from last year, signaling a potential oversupply unless matched by equivalent demand.

- Units Reported Sold: 82 units have been sold to date, up 18.84% from last year, indicating a steady but not explosive growth in buyer activity.

- Sell/List Ratio: The ratio for the year to date is 25.46%, consistent with the 12-month trend and reflecting a stable but cautious market.

- Reported Sales Dollars: Sales dollars for the year to date totaled $34,129,953, a 13.58% increase, suggesting that higher value transactions are occurring despite the challenges.

- Average Sell Price/Unit: The average price per unit year to date stood at $416,219, slightly down by 4.43% from last year, reinforcing the buyer’s market conditions.

- Median Sell Price: Trends in the median sell price are showing a stabilization in prices compared to the broader fluctuations.

- Sell Price/List Price Ratio: This ratio has seen a slight improvement, reflecting a steady market from a pricing agreement standpoint.

- Days to Sell: The days to sell have averaged 119 this year, up from 84, showing a slowdown in sales velocity.

- Active Listings: Continued growth in active listings suggests that inventory management will be crucial for market stability.

Impact on Buyers:

The current average sell price per unit indicates that buyers might find more negotiating power in today’s market. The slower days to sell and increased inventory suggest that buyers can afford to be selective, potentially driving better deals. Given the upcoming changes in interest rates by the Bank of Canada, prospective buyers should consider the timing of their purchases, as borrowing costs could affect affordability.

Impact on Sellers:

Sellers are facing a market where they need to price competitively to attract buyers. The increased days to sell and the high inventory levels suggest that sellers need to adjust expectations and may need to wait longer for successful transactions. Strategic pricing and effective marketing have become more critical than ever in securing sales at desirable prices.

Market Sentiment:

This comprehensive analysis of Vancouver Island Property Values for March 2024 illustrates a market experiencing significant shifts. Buyers appear to have an upper hand due to increased supply and reduced pricing, while sellers must adapt to a more competitive landscape. Stakeholders should monitor these trends closely, as they offer important insights into the future direction of the market.

Recommendations Based on Insights:

For buyers, the current conditions offer a favorable opportunity to negotiate on price and terms. Sellers, however, may need to be flexible and patient, particularly if the market continues to show signs of cooling. Investors should consider long-term trends and potential shifts in market dynamics before committing to new acquisitions.

For personalized insights into how these trends can benefit your real estate decisions on Vancouver Island, whether you are buying, selling, or investing, don’t hesitate to reach out. Explore your options based on a comprehensive analysis provided in this report.

🔍 Seeking market insights? Discover how trends can benefit you!

🏠 Thinking of Buying or Selling?

📲 Call or Text: 1-250-252-SOLD

For Expert Advice, visit https://jasonanson.ca/book-a-call/.

Comments are closed