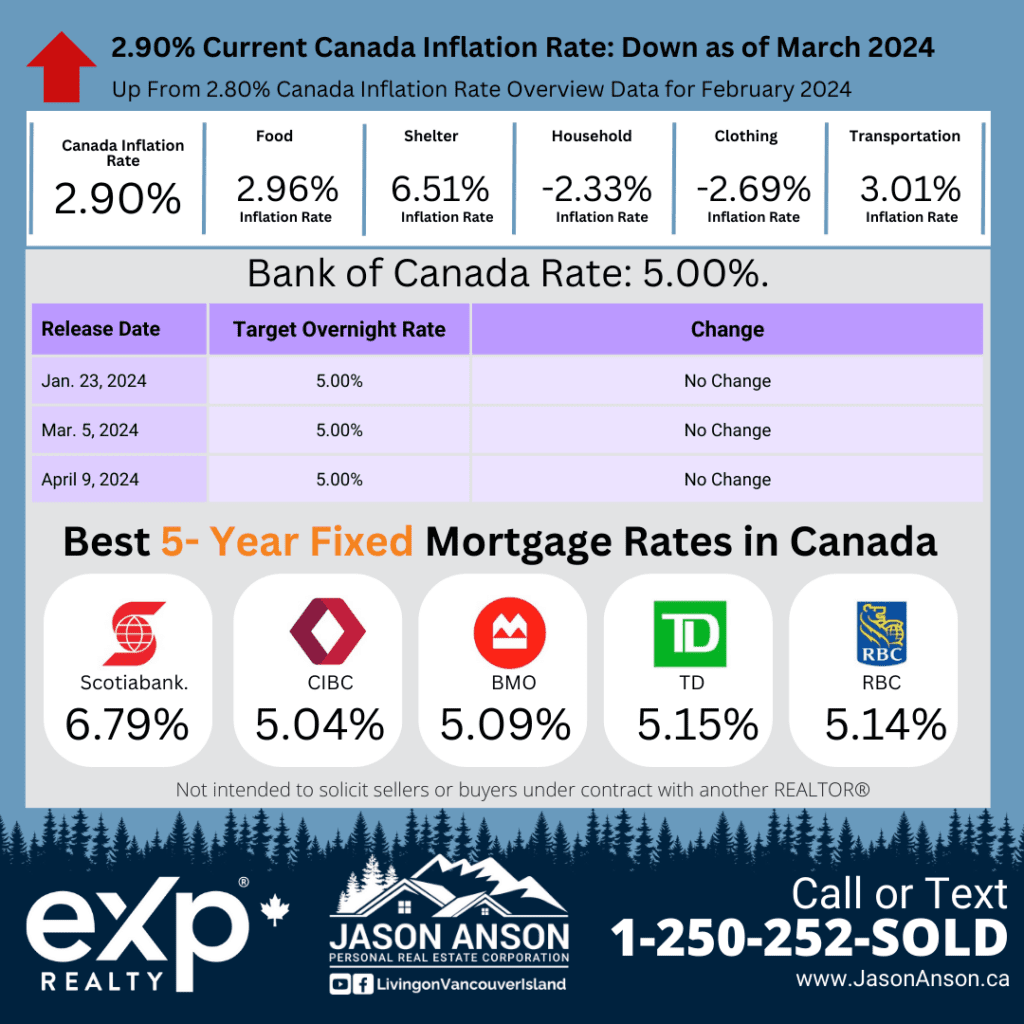

The Bank of Canada has announced that it will keep its policy rate at 5%, continuing its approach of quantitative tightening. This stability comes amid a noticeable decrease in inflation, which dropped to 2.8% in February from earlier figures of 2.9% in January and 3.4% in December.

Interest rates may see a reduction soon, given the recent economic indicators. Unemployment has increased from 5% at the start of 2023 to 6.1% by March 2024, suggesting a slight softening in the job market. Meanwhile, Canada’s GDP growth has been tepid, with a marginal 0.2% increase in the fourth quarter of 2023 following a 0.1% contraction in the previous quarter. Additionally, after a rise in retail sales in December 2023, there has been a downturn starting January.

There are also signs of financial strain, as major banks report a rise in delinquencies and warn of a potential recession. Over the past two years, the Bank of Canada rapidly raised its policy rate from 0.25% in March 2022 to 5% in response to soaring inflation, which peaked at a 30-year high of 8.1% in June 2022. This led to one of the most vigorous cycles of rate hikes in Canadian history. However, with inflation cooling since then, there may be a gradual shift towards lower interest rates, although this could increase the burden on those with significant debt.

For real estate professionals and clients, understanding these economic trends is crucial for navigating the market effectively and anticipating changes in mortgage rates and housing demand.

Comments are closed