In March 2024, the North Vancouver Island real estate market experienced notable fluctuations. This report delves into the current home values, sales trends, and market dynamics, offering a comprehensive overview based on the latest data from the Vancouver Island Real Estate Board.

Economic Conditions:

With the Bank of Canada’s policy rate steady at 5%, the economic landscape in March 2024 shows a mixed bag of indicators. Despite a slight increase in unemployment to 6.1% and a slowdown in GDP growth, retail sales have dipped, suggesting a cautious consumer sentiment. For the real estate sector, these factors could mean a more balanced market, potentially easing the rapid price increases seen in previous years.

Supply and Demand:

March 2024 saw a decrease in listings and sales volume for North Vancouver Island homes compared to the previous year, indicating a cooling phase in the market. Units listed decreased by 30% from last year, while units sold dropped by nearly 67%. These shifts suggest a tightening market with fewer available homes, impacting both buyers and sellers.

North Vancouver Island Real Estate Market Overview for March 2024:

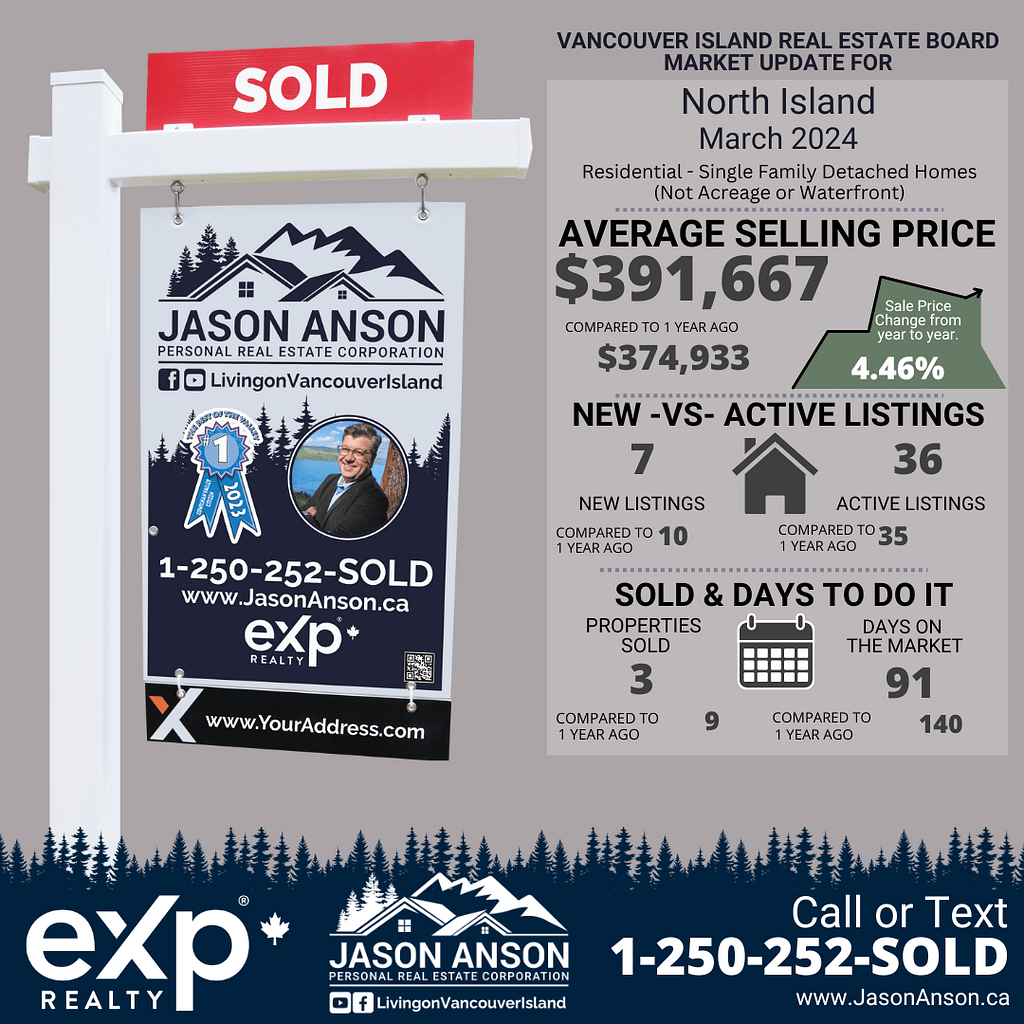

The real estate market in North Vancouver Island in March 2024 showed signs of adjustment, with a 30% decrease in units listed compared to last year and a significant 66.67% drop in units reported sold. The average sell price per unit rose by 4.46%, indicating that despite lower sales volumes, property values remain robust. Key economic indicators such as employment rates and interest rates are playing a crucial role in shaping market dynamics.

Detailed Analysis:

March 2024’s detailed market analysis highlights a sharp decrease in activity compared to the previous year, with significant decreases in both listings and sales volumes. The sell/list ratio also declined from 90% last year to approximately 42.86%, reflecting a tougher market for sellers but potentially better negotiation leverage for buyers.

North Vancouver Island Real Estate Market Insight: Comparative Activity by Single Family Detached for March and 2024:

The comparative activity in North Vancouver Island’s single-family detached sector shows a notable decrease in listings and sales, with reported sales dollars dropping by 65.18% to $1,175,000. The average selling price per unit increased, suggesting that while fewer homes are being sold, those that do are fetching higher prices.

Current Month Analysis:

- Units Listed: There were 7 units listed in March 2024, a decrease of 30% from the previous year.

- Units Reported Sold: Only 3 units were reported sold, a significant reduction of 66.67% from last year.

- Sell/List Ratio: The sell/list ratio was 42.86%, down from 90% the previous year, indicating a less competitive market.

- Reported Sales Dollars: Total sales amounted to $1,175,000, down 65.18% from March of the previous year.

- Average Sell Price/Unit: The average selling price was $391,667, an increase of 4.46% from last year.

- Median Sell Price: The median sell price stood at $375,000.

- Sell Price/List Price Ratio: The sell price to list price ratio slightly improved to 93.64%.

- Days to Sell: Homes took an average of 91 days to sell, a decrease from 140 days last year.

- Active Listings: There were 36 active listings, slightly up from 35 last year.

12 Months to Date Analysis:

- Units Listed: Over the past 12 months, 110 units were listed, marking a decrease of 24.66%.

- Units Reported Sold: A total of 54 units were sold, down 27.03% from the previous year.

- Sell/List Ratio: The sell/list ratio averaged 49.09%, reflecting ongoing market adjustments.

- Reported Sales Dollars: The total sales dollars were $23,255,900, a decrease of 25.43%.

- Average Sell Price/Unit: The average selling price over the last 12 months was $430,665, slightly up by 2.19%.

Year to Date Analysis:

The year-to-date analysis shows a decrease in both listings and sales, with a 7.41% decrease in units listed and a 28.57% decrease in units sold. The average sell price per unit increased significantly by 18.79%, indicating a market that still holds value despite reduced activity.

Impact on Buyers:

Current trends suggest a slight buyer’s advantage due to increased negotiation power, with a noted decrease in the sell/list ratio and a longer average selling period. However, the increase in average selling price per unit indicates that well-priced properties are still achieving good value.

Impact on Sellers:

Sellers are facing a tougher market with fewer sales and longer selling times. However, those who do sell are achieving relatively high prices, which could encourage sellers to hold out for better offers.

Market Sentiment:

As we wrap up this report on North Vancouver Island’s real estate market for March 2024, it’s clear that while the market has cooled, property values remain strong. For those considering buying or selling, now may be a time of opportunity, depending on individual circumstances and market positioning.

Comments are closed