What Is the Best Way to Win a BC Assessment Appeal?

What Is the Best Way to Win a BC Assessment Appeal? Homeowners across British Columbia ask this each January when notices arrive. Winning means proving your assessed value should reflect actual market value as of the July 1 valuation date and the October 31 property condition date. A disciplined approach, grounded in evidence, can reduce your BC property assessment and lower your property tax fairly.

Focus your case on verifiable evidence

The best way to win is to rely on facts, not opinions. Comparable sales that bracket your home’s size, age, and location around the July 1 valuation date carry the most weight. Ensure your submission reflects the property’s condition as of October 31. Time stamped photos, permits, and even appraisals dated October 31 can strengthen your evidence package.

Steps that help you succeed

Winning a BC Assessment appeal requires clarity and preparation. Here are steps that consistently make a difference:

- Request your BC Assessment Property Record Card with internal notes and confirm all details are correct.

- Assemble MLS Listing sheets for comparable sales, anchoring them to July 1.

- Bracket your comparables into low, mid, and high price ranges. For example: $900,000 low, $1,000,000 mid, $1,100,000 high. Your property should reasonably fit within this spread.

- Provide photos of your property’s condition as of October 31, ideally time stamped. This app is useful for verifiable photos.

- File before the January 31 deadline to preserve your rights with the Panel and Board.

Top 5 Things to Know About What Is the Best Way to Win a BC Assessment Appeal?

Quick checklist to keep in mind when dealing with What Is the Best Way to Win a BC Assessment Appeal?.

- Comparable sales win - choose recent, nearby, and similar properties tied to July 1.

- Your PRC matters - Get Your BC Assessment Property Record Card with Internal Notes to uncover errors and strengthen your appeal.

- Dates control the outcome - July 1 valuation, October 31 condition, and January 31 appeal deadline.

- Evidence beats opinion - recent, similar, properly adjusted sales outweigh broad headlines or homeowner estimates.

- Escalate wisely - if necessary, use FOI requests, hire an appraiser, or seek representation. Learn more at The FOI Evidence Locker.

Why preparation beats assumption

Many homeowners assume their assessment is accurate until taxes rise. BC Assessment relies on mass appraisal, often using broad regional stats. By presenting comparables specific to your neighbourhood and property type, you correct systemic blind spots and improve fairness across the roll.

What if sales are limited?

Rural, waterfront, and unique properties often lack direct comparables. Widen your search radius carefully, keep similarity high, and explain adjustments. If necessary, expand your time frame and apply time adjustments back to the July 1 valuation date.

From the BC Property Tax Search Article Series

Learn about each stage of the BC property assessment appeal system:

- The Assessor: BC Assessment Appeals Process

- Appeal Round 1 - The Panel: Property Assessment Review Panel (PARP)

- Appeal Round 2 - The Board: Property Assessment Appeal Board of BC (PAAB)

What Is the Best Way to Win a BC Assessment Appeal? FAQ

Do I need a lawyer to win a BC Assessment appeal?

What deadlines matter most in winning?

How do I get my BC Assessment Property Record Card with internal notes?

What if my appeal is unsuccessful?

Trusted by BC Homeowners Province Wide

Voted Best Real Estate Agent by Cowichan Valley Citizen Readers’ Choice and featured on the front page of the Times Colonist, I consistently earn 5-star Google reviews for transparent advocacy. Results include more than $20M in reductions, six-figure cumulative refunds, and a strong record before the Board. Learn more about Jason Anson or see my BC Assessment Appeals results.

Get Your BC Assessment Property Record Card with Internal Notes Now

Correcting errors in your PRC can strengthen your case and help align assessed values with your actual market value in your neighbourhood.

What you’ll learn

- How to request your PRC with internal notes

- How to identify errors that inflate your assessment

- How to compare PRC data with real MLS sales

Free for homeowners across British Columbia.

Categories

- All Blogs (78)

- BC Property Tax Search (10)

- Cost of Living on Vancouver Island (2)

- Living on Vancouver Island (26)

- Most Affordable Communities in Campbell River (1)

- Most Affordable Communities in Nanaimo (1)

- Most Affordable Communities in Parksville and Qualicum (1)

- Most Affordable Communities in the Comox Valley (1)

- Most Affordable Communities in the Cowichan Valley (1)

- Most Affordable Communities in the North Island (1)

- Most Affordable Communities in the Surrounding Islands (1)

- Most Affordable Communities on Vancouver Island (1)

- Most Expensive Communities in Campbell River (1)

- Most Expensive Communities in Nanaimo (1)

- Most Expensive Communities in Parksville and Qualicum (1)

- Most Expensive Communities in the Comox Valley (1)

- Most Expensive Communities in the Cowichan Valley (1)

- Most Expensive Communities in the North Island (1)

- Most Expensive Communities in the Port Alberni Area (2)

- Most Expensive Communities in the Surrounding Islands (1)

- Most Expensive Communities on Vancouver Island (1)

- People’s Choice Awards (10)

- Real Estate Market Guide (6)

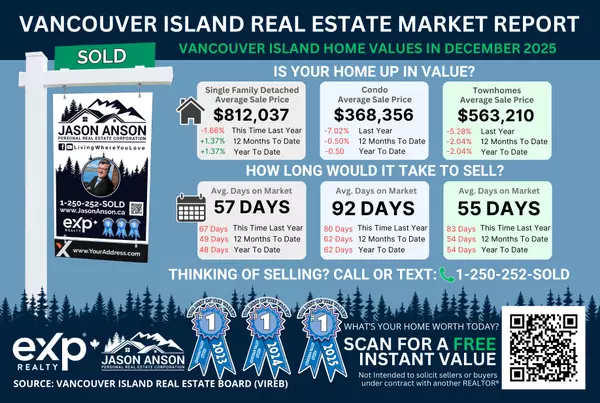

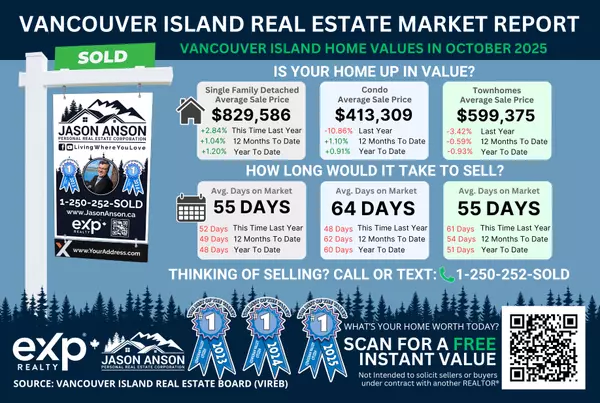

- Vancouver Island Real Estate Market Reports (3)

- Youbou Real Estate Market Reports (3)

Recent Posts

Thinking About Selling or Buying?

Market conditions change quickly and what looks like a sellers’ market today may balance out in the months ahead. If you are planning to sell your home or purchase a property, having the right data and strategy at the right time is key.

I provide custom Market Movement reports and strategy sessions so you understand exactly where your property stands before making your next move. Connect with me below to get started.