What Deadlines Matter in a BC Assessment Appeal?

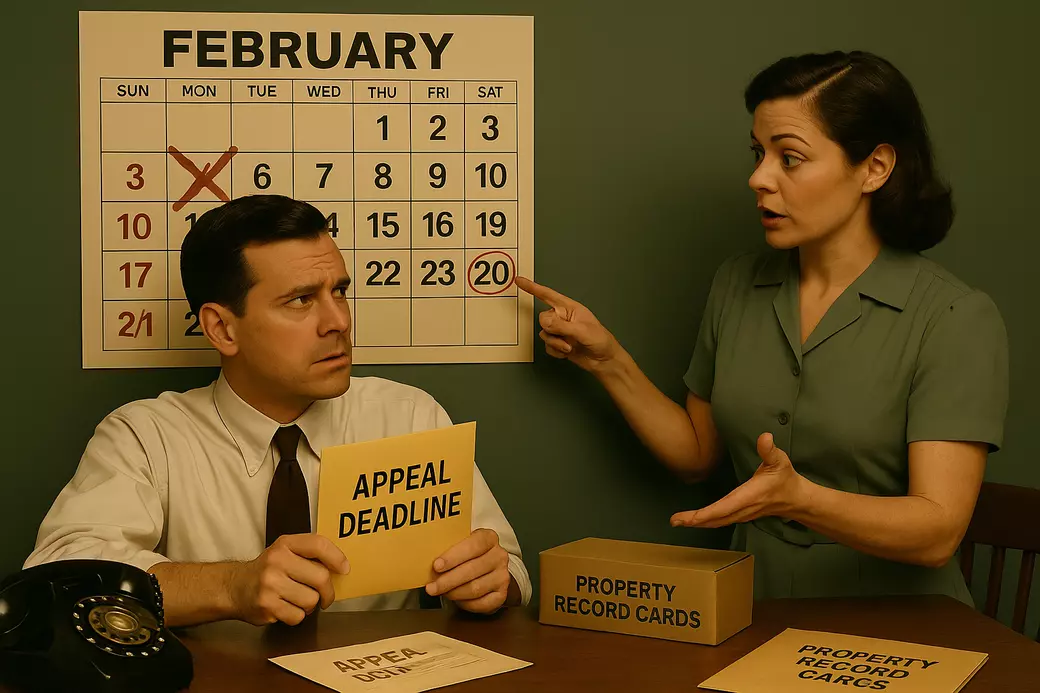

What Deadlines Matter in a BC Assessment Appeal? This is one of the most important questions for homeowners across British Columbia. Missing even a single date in the BC property assessment appeal process can cost you your chance to lower your assessed value and reduce your property taxes owed.

Key BC Assessment appeal deadlines every homeowner must know

The BC Assessment Authority works on strict timelines tied to the Assessment Act. These are the critical dates:

- January 31: Final deadline to file your appeal to the Property Assessment Review Panel (PARP).

- February 1 to March 15: Telephone-in PARP hearings are scheduled in communities across BC.

- March 15 to April 30: PARP decisions are issued. If unsatisfied, you must file an appeal with the Property Assessment Appeal Board (PAAB) no later than April 30.

- May 1 onward: PAAB appeals are reviewed. Most are completed in 3 to 6 months, but some carry forward into the following year.

- July 1: Valuation Date, all assessed values are based on the market as of this day.

- October 31: Property Condition Date. Photos, appraisals, or documentation timestamped on or near this date carry strong weight. A simple way to capture evidence is with the Timestamp Camera app.

Why the January 31 deadline matters most

If you do not file your appeal by January 31, you lose the right to appeal your assessment for that year. Missing the April 30 escalation date means you cannot take your case to the Property Assessment Appeal Board. Forgetting the October 31 property condition date could mean your evidence, such as renovations, damages, or structural changes, is ignored. Each date protects your right to be assessed fairly.

Top 5 Things to Know About What Deadlines Matter in a BC Assessment Appeal?

Quick checklist to keep in mind when dealing with What Deadlines Matter in a BC Assessment Appeal?.

- File by January 31, or you lose the right to appeal for that year.

- Prepare early, review your Property Record Card and sales evidence before the rush in January.

- Know the PARP schedule, hearings run February 1 to March 15 in your region.

- Escalation deadline, if you disagree with PARP you must file with the PAAB by April 30.

- Remember October 31, the property condition date, timestamped photos and appraisals from that day are powerful evidence.

Additional Insights

Deadlines are not just bureaucratic rules, they protect the integrity of the assessment roll. Filing on time ensures fairness between neighbours, whether you live on Vancouver Island, in the Lower Mainland, or in smaller communities like Nelson or Vernon. Keep the July 1 valuation date and the October 31 property condition date in mind when gathering evidence.

How to stay ahead of deadlines

Mark key dates on your calendar in December, request your Property Record Card early, and gather MLS comparables before the holiday season ends. Being proactive means you will not scramble in the final week of January. If you need to document condition, take timestamped photos on October 31, or consider an appraisal as close to that date as possible.

From the BC Property Tax Search Article Series

Learn about each stage of the BC property assessment appeal system:

- The Assessor: BC Assessment Appeals Process

- Appeal Round 1 - The Panel: Property Assessment Review Panel (PARP)

- Appeal Round 2 - The Board: Property Assessment Appeal Board of BC (PAAB)

What Deadlines Matter in a BC Assessment Appeal? FAQ

What is the most important BC Assessment appeal deadline?

Can I still appeal after missing January 31?

When does the Property Assessment Review Panel meet?

How quickly can I escalate to the Property Assessment Appeal Board?

What is the property condition date, and why does it matter?

Trusted by BC Homeowners Province Wide

I was voted Best Real Estate Agent by Cowichan Valley Citizen Readers’ Choice and featured on the front page of the Times Colonist. I earn consistent 5 star Google reviews, and my results include more than $20M in reductions, over $100k in refunds, and a 91% win rate. Learn more about me or see my BC Assessment Appeals results.

Get Your BC Assessment Property Record Card Today

Unlock hidden details in your Property Record Card before appeal deadlines arrive. Errors in BC Assessment’s file can inflate your value. Correcting them is often the fastest path to a fairer assessment.

What you’ll learn

- How to request your PRC with internal notes

Free for homeowners across British Columbia.

Categories

- All Blogs (78)

- BC Property Tax Search (10)

- Cost of Living on Vancouver Island (2)

- Living on Vancouver Island (26)

- Most Affordable Communities in Campbell River (1)

- Most Affordable Communities in Nanaimo (1)

- Most Affordable Communities in Parksville and Qualicum (1)

- Most Affordable Communities in the Comox Valley (1)

- Most Affordable Communities in the Cowichan Valley (1)

- Most Affordable Communities in the North Island (1)

- Most Affordable Communities in the Surrounding Islands (1)

- Most Affordable Communities on Vancouver Island (1)

- Most Expensive Communities in Campbell River (1)

- Most Expensive Communities in Nanaimo (1)

- Most Expensive Communities in Parksville and Qualicum (1)

- Most Expensive Communities in the Comox Valley (1)

- Most Expensive Communities in the Cowichan Valley (1)

- Most Expensive Communities in the North Island (1)

- Most Expensive Communities in the Port Alberni Area (2)

- Most Expensive Communities in the Surrounding Islands (1)

- Most Expensive Communities on Vancouver Island (1)

- People’s Choice Awards (10)

- Real Estate Market Guide (6)

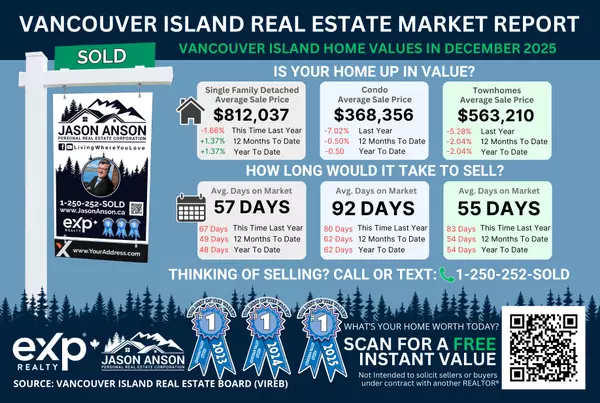

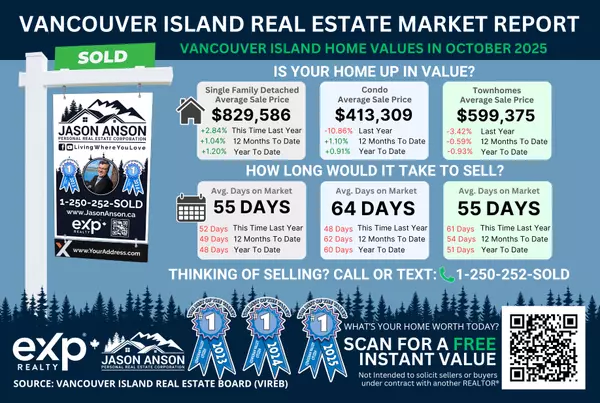

- Vancouver Island Real Estate Market Reports (3)

- Youbou Real Estate Market Reports (3)

Recent Posts

Thinking About Selling or Buying?

Market conditions change quickly and what looks like a sellers’ market today may balance out in the months ahead. If you are planning to sell your home or purchase a property, having the right data and strategy at the right time is key.

I provide custom Market Movement reports and strategy sessions so you understand exactly where your property stands before making your next move. Connect with me below to get started.