BC Assessment Appeals

Over $20 Million in BC Property Assessment Reductions • $100,000+ in Property Tax Refunds • 91% Win Rate

BC Assessment Appeals give homeowners the opportunity to correct unfair or inaccurate values so that property taxes reflect actual market value rather than errors. Every January thousands of families across British Columbia receive assessments that put their equity at risk. I have guided homeowners through appeals that delivered more than $20 million dollars in reductions and over $100,000 dollars in tax refunds with a success rate of ninety one percent. Here is how you can protect your equity this year.

It Started With a Food Bank and a Fight for Fairness

BC Assessment appeals were never part of my career plan. It began when my small community of Youbou was hit with some of the highest assessments on Vancouver Island. As the Cowichan Valley Citizen reported, “The average waterfront properties in Youbou have risen in value a whopping 28 per cent from last year, according to BC Assessment, the highest increase in the Cowichan Valley.” Families were shocked and deeply worried, not only about losing their Home Owner Grant but also about whether they could keep their homes after property taxes had more than doubled in just three years. Concern turned into action when residents called a meeting at the local church hall and asked me to speak about the real estate market. I stepped forward as a neighbour who wanted to help. From that night we formed a community appeal group, and I volunteered to lead. When the appeal form asked for an authorized agent I put down my name without fully knowing what that role meant. What I did know was that people needed support.

It is important for readers to understand that appeal work is not a licensed activity under the Real Estate Services Rules and Act, and at that time I never offered it as a professional service. In fact, I had never filed an appeal before, so there was no way for any of us to predict the outcome. To keep it fair I agreed to do the work pro bono, asking only for donations to the Lake Cowichan Food Bank. Together we raised $6,750. To protect both myself and my brokerage everyone signed a waiver confirming there were no guaranteed results. If we won, we won. If we lost, we lost. For the community it felt like there was nothing to lose, and while it turned into a tremendous amount of work, the donations kept the effort rooted in community rather than business.

From Authorized Agent to Expert Witness

For more than six months BC Assessment delayed, refusing to engage with the group or provide any evidence to support their valuations. When they finally ran out of road and had to appear at a Zoom hearing with the Provincial Assessment Appeal Board, they showed up with King’s Counsel. Homeowners were outraged. They saw the introduction of a senior lawyer as a bully tactic, especially since I had been effective in presenting comparables and explaining market trends while BC Assessment continued to provide no evidence.

The lawyer quickly shut down the meeting. Since I had listed myself as the authorized agent, I was now in a position of negotiating directly in a legal forum against King’s Counsel. Because I did not own one of the properties under appeal, I could not be considered self-representing and was not a lawyer. I had no choice but to withdraw.

With my withdrawal, King’s Counsel was left to deal with the homeowners individually rather than facing a single community leader. In a surprising twist, the very next day King’s Counsel also withdrew.

That left BC Assessment dealing directly with the homeowners, which in my opinion was exactly what they wanted. From what I witnessed it seemed more than likely that senior staff and appraisers felt they could mislead inexperienced homeowners one-on-one. The group, which consisted mostly of seniors with no experience, saw it as a divide-and-conquer strategy being employed. What changed the balance was that I had the foundational knowledge to assess homes, proven by scoring 100 percent on the Appraisal Methods component of my UBC Real Estate Exam. Combined with access to comprehensive data and advanced evidence, I was able to put the homeowners in a position of strength.

What BC Assessment did not realize was that while they were spinning their wheels and burning time, the group had already come up with our own strategy. BC Assessment could waste as much time as they wanted trying to explain things to the homeowners. However, when the case later moved to written submissions, I was able to return as an expert witness and write the appeals for them.

That moment marked the beginning of a journey that has since helped homeowners achieve more than $20M in reductions and $100K in refunds while protecting their equity year after year.

Flagged. Scored. Tracked.

The seniors and homeowners were understandably upset, and that is when BC Assessment introduced a mass home inspection program targeting 150 homes in Youbou. Inspectors goose-stepped into the community telling residents they had no choice and even claimed the RCMP had been informed. In other words, homeowners were told they had better comply, and everyone did.

But they would not stay quiet. Their stories reached the press and were featured in more than 25 news articles that were syndicated over 415 times across more than 67 news media outlets in British Columbia. Highlights included front-page coverage in the Times Colonist, province-wide syndication of appeal results, and features on community initiatives that delivered millions in reductions and thousands in property tax refunds for local homeowners.

(Source: Screenshot from BC Assessment’s internal media tracking system, November 2023)

That media reach is exactly what BC Assessment was watching. A whistleblower inside the agency later sent me a screenshot showing my face flagged in their internal media monitoring system.

After seeing the screenshot I filed a Freedom of Information request for records that mentioned my name, Jason Anson. The response was more than 1,300 pages long. In those records BC Assessment repeatedly referred to me as "The Realtor" helping the "Youbou Appeal Group." That was the label they gave us, and it stuck.

The documents showed monitoring and coordination at a very high level. Legal department staff, media liaisons and communications writers were tracking coverage, and the Vice President was included in the threads. They were communicating directly with the Provincial Assessment Review Panel Administrator and with senior staff across the Minister of Finance office. Taken together the records show a coordinated effort within BC Assessment aimed at the homeowners.

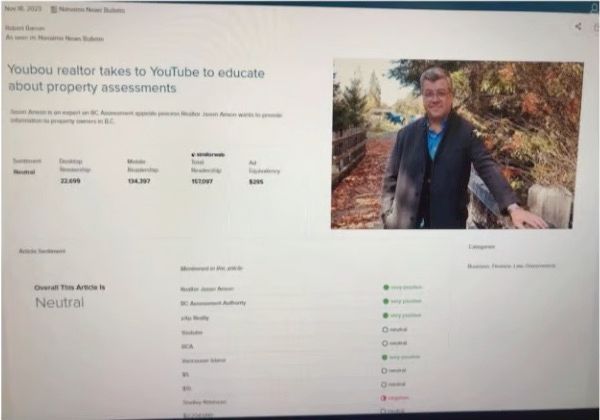

They Called It "Situations to Watch For”

By December 2023 the appeals had still not been resolved. It felt like BC Assessment had done everything possible to delay the written submission stage of the process. Nearly a year had passed since January 2023 and now we were entering the new appeal season with the old one still unresolved.

That same month a whistleblower who was in a staff training session sent me a screenshot. The slide was titled Situations to Watch For and it named my community, Youbou, directly. The slide instructed staff to flag complaints if they involved coordinated groups, media attention, or the possibility of escalation to the Minister.

This was not a situation they were preparing for. It was one they were already facing. We created it.

There was no playbook for homeowners so we built one. We organized. We appealed. We documented every inspection. We wrote to the Minister. We wrote to newspapers and they published our letters.

Our actions did not react to BC Assessment policy. They became the reason for it. Instead of reform BC Assessment chose surveillance.

(Source: Internal BC Assessment staff training slide, December 2023 “Situations to Watch For”)

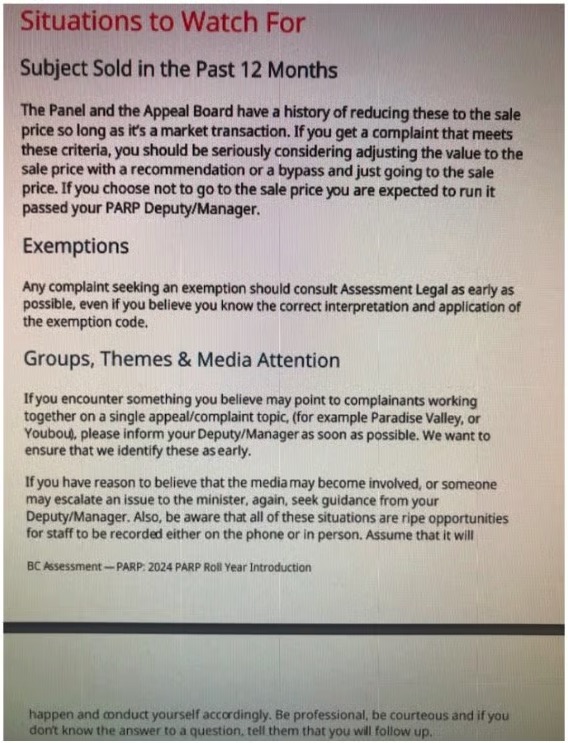

91% Win Rate. Over 30 Board Decisions. $13.6M Reduced

At the Provincial Assessment Appeal Board I supported 34 BC Assessment appeals from my community. The result was a 91.2 percent win rate and $13.6 million in reductions.

(Source: Board Appeal Record Card, 2023–2024)

But numbers only tell part of the story. Because Board decisions take months our group did not have final outcomes before the 2024 appeal deadline. To protect every homeowner’s right to continue we refiled what we called a “holding appeal.” It was an extra step but it preserved fairness for everyone involved.

When the decisions were finally released we had won. The reductions confirmed that our evidence was accurate. The Times Colonist reported the story on its front page. Soon after a Freedom of Information release showed that BC Assessment was briefing the Minister’s Office about the Youbou Appeal Group and had labeled us in its staff training as “situations to watch for.”

After those decisions BC Assessment quietly offered another $4 million in reductions, but only to the homeowners who had already won. The condition was that they not proceed to the Board for their second-round property tax appeals. It was not an effort to reform the system. It was an effort to contain the story.

For the three homeowners on my 2023 record who received no offer and lost the process continued. They got back in line and BC Assessment chose to fight them at the Board in 2024. This time they prevailed, securing another $748,000 in reductions collectively. Using the same holding appeal strategy those homeowners refiled again in 2025 and achieved a further $700,000 in reductions. For me it was always about accuracy and fairness and making sure no one in my community was left behind.

What the official Board statistics do not show are the dozens of homeowners I supported at the panel level. Those outcomes are not tracked in Board records but represent at least another $3 million in reductions across our community. In total the combined effort secured more than $20 million in BC property assessment reductions in just two years, protecting the equity of families who might otherwise have overpaid.

Why I No Longer Testify as an Expert Witness

I stopped offering expert witness services on July 1, 2025 not because my evidence failed but because the system began rejecting success. By that point every homeowner I committed to help in the Youbou Appeal Group had won. The final Board decisions had been issued. The last appeals were resolved. We had done what we set out to do and the results spoke for themselves.

Over the past three years I helped homeowners secure more than $20 million in property assessment reductions with property tax refunds over $100,000. But then something changed. The system stopped debating my evidence on the facts and started questioning my motives.

In the last ruling of the Youbou Appeal Group the Board admitted my reports were exceptionally detailed but still gave them little weight. Not because they were wrong, but because I cared too much.

“I observe Mr. Anson has provided an exceptionally detailed review of the subject and the comparables. However, I have also noted concerns with Mr. Anson’s advocacy role potentially clouding his objectivity as an expert witness.”

Ross v. Area 4, 2025 PAABBC 20242424

That was the moment I knew the problem was not the quality of my work. It was that I was helping homeowners win. And that became the problem.

Expert evidence is supposed to be judged on its content, not on whether the expert has helped too many homeowners. The moment a tribunal stops weighing what you say and starts questioning why you are saying it, that is not impartial. That is not fair. And legally, that might be crossing a line.

That standard was not applied to BC Assessment’s experts. It was applied only to me. Because I was not just another suit at the table. I was exposing the flaws in their data, their models, and their logic.

The homeowner Andy Ross was upset that the Board criticized their expert witness. He felt they had no right to undermine the supports that seniors in Youbou relied on. To him and to many others in the group it looked like another attempt to remove the help they had fought to organize. That is when Andy said, “they got a Dock Fight now.” It became a turning point. The Youbou Appeal group chose to move beyond the hearing room and into public advocacy by sharing their story in a Podcast.

From Expert Witness to Advocate

So I made a choice. I no longer testify. I advocate.

What I have now is a good understanding of the biases between BC Assessment, the Property Assessment Review Panel, and the Property Assessment Appeal Board. These are subtle nuances that most homeowners will never be able to piece together while doing one appeal at a time. I deconstruct the process on the podcast through storytelling so that homeowners in British Columbia understand the seriousness of what is happening and how it is affecting so many families unknowingly, costing them thousands more in property taxes they likely had no idea about.

My advocacy now takes many forms, but one of the most practical is writing my BC Property Tax Search articles. These articles share insights, data, and results based on real cases and lived experience. They are written to help homeowners understand how the system works, what patterns to look for, and how to protect their equity.

Through this work I continue the same mission that began in Youbou, giving everyday homeowner's the knowledge and strategies they need to file successful property assessment tax appeals in British Columbia.

BC Property Tax Search: Insights, Data and Results

Why Homeowners Trust My BC Assessment Appeals Advocacy

A BC Assessment appeal can feel overwhelming, but homeowners know they are not alone. My role has always been about advocacy, protecting equity and making the process fairer. With more than $20 million in reductions secured and over $100,000 in refunds returned, I bring experience, evidence, and a record of results that speak for themselves.

Top 5 Reasons Homeowners Trust My Advocacy

- Proven $20 million in reductions and more than $100,000 in property tax refunds

- Ninety one percent win rate across more than 30 Property Assessment Appeal Board decisions

- Expert witness record documented in official tribunal rulings

- Step by step approach from Property Record Cards to Board level outcomes

- Provincial media coverage highlighting homeowners wins

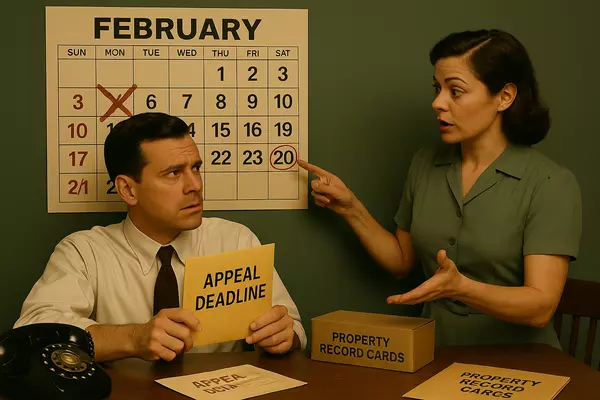

Deadlines and Timelines

Every January BC Assessment sends notices that set property values for the year ahead. If a homeowner believes the assessment is unfair the appeal must be filed before January 31. Missing the deadline means waiting another year. Knowing the timeline is critical to protecting equity.

Property Record Cards

The Property Record Card or PRC is the foundation of every BC Assessment appeal. It contains the land, building, and valuation details used to calculate the number. Finding errors or inconsistencies in the PRC can mean the difference between paying too much or securing a fair tax bill.

Common Mistakes

Many homeowners lose BC Assessment appeals not because they are wrong but because they rely on opinion instead of evidence. Filing late, ignoring PRC errors, or failing to provide comparable sales data are the most common reasons appeals fail. A strong appeal is always evidence based.

Success Rates

Over the past three years homeowners in my community secured more than $20 million in BC Assessment reductions with more than $100,000 in property tax refunds. The Board records show a ninety one percent win rate. These outcomes prove that evidence, preparation, and persistence protect equity.

Curious how BC Assessment values compare to the real estate market? Visit my Vancouver Island Real Estate Market for the latest sales data, pricing trends, and time to sell insights.

Seeing both your assessment and your market value side by side is the key to protecting equity and planning your next move with confidence.

For official information on assessment notices, property record cards, and filing procedures, visit the BC Assessment website ↗. You can also learn more about the formal appeal process at the Property Assessment Appeal Board ↗.

BC Assessment Appeals FAQ

What is the best way to win a property tax appeal?

How do I appeal a notice of assessment?

How can I dispute my property assessment in BC?

BC Assessment Appeals in the News

Media coverage has documented the journey of homeowners challenging BC Assessment. These highlights show how advocacy and persistence led to real results.

- Times Colonist - Lake Cowichan residents win $10.5M in assessment reductions

- Vancouver Island Free Daily - Homeowners break a cycle of over assessment

- Today in BC - 1,000 door campaign on property assessments

Take the Next Step in Your BC Assessment Appeal

Homeowners in my community have reduced more than $20 million in assessments and secured over $100,000 in property tax refunds. These results show what is possible when evidence and preparation meet persistence.

- Learn the appeal process from start to finish

- Use FOI-backed evidence and real case examples

- Protect your equity and avoid overpaying property taxes

Explore my free resources and BC Property Tax Search articles to see how other homeowners have succeeded in their BC Assessment appeals.

Discover Vancouver Island Regions

This page highlights my record with BC Assessment Appeals, helping homeowners understand and challenge property values that may not reflect reality. Assessments influence both taxes and equity, but they are not always correct. I have lived on Vancouver Island for more than 30 years and have seen how neighbourhoods and regional demand impact property values. In my professional work I focus on proving actual market value with market movement data, giving homeowners clear evidence to support an appeal and protect their interests. Use these guides to explore regional areas and see how assessments and appeals connect with the wider housing story of the island at Living on Vancouver Island.