What Is the Best Evidence to Protest Property Taxes in BC?

What Is the Best Evidence to Protest Property Taxes in BC? If you plan to challenge your BC Assessment value, the right evidence is everything. Strong, well organized proof makes it easier for the Property Assessment Review Panel and the Property Assessment Appeal Board of BC to understand why your assessed value should reflect actual market value at the July 1 valuation date and the October 31 property condition date.

The most persuasive evidence for a BC Assessment appeal

Evidence wins cases when it is recent, similar, and clearly tied to the statutory dates. Focus your submission on:

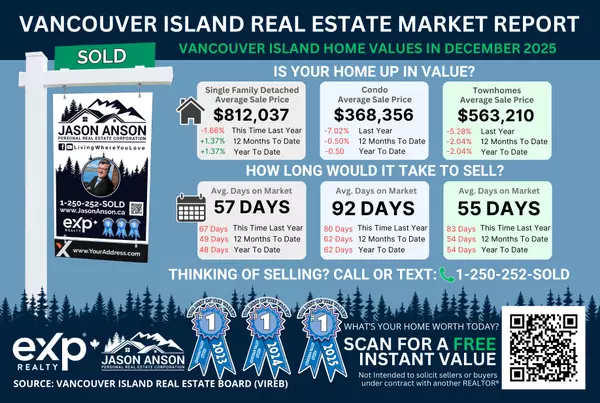

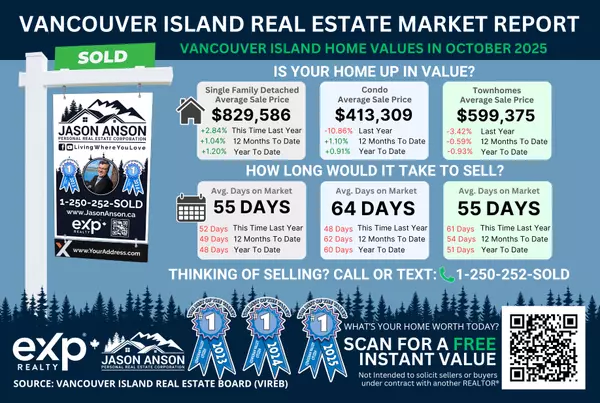

- Comparable sales around the July 1 valuation date, preferably within your neighbourhood and of similar size, age, condition, and land influences. Start with the Sold Listings page, find sales near July 1, then bracket a low, mid, and high price range that reflects what they sold for.

- MLS Listing sheets, these are the gold standard for documenting features, condition, and sale details. Include the full data sheet for each comparable, not just a headline price.

- Your BC Assessment Property Record Card with Internal Notes, verify every detail, like living area, quality, condition, renovations, view, waterfront, and outbuildings. If details are wrong, your value can be wrong. Get Your BC Assessment Property Record Card and use it to catch costly errors early.

- Condition evidence dated near October 31, that is the official property condition date. Time stamped photos, invoices, and an appraisal dated on or close to October 31 are especially persuasive. For photos, you can use the Timestamp Camera app.

- Objective documents, permits, engineering or insurance reports, environmental or geotech notes, anything that materially affects market value at the valuation date.

How to organize your comparables and narratives

Arrange your sales in a simple grid, then explain why each sale is similar or different. Where needed, make modest, clearly stated adjustments for size, age, site influences, and condition, so the panel can see a logical path to your opinion of value.

- Bracket your evidence with three clear anchors, low, mid, and high price points, for example, $900k low, $1.0M mid, $1.1M high. Ideally your home will fall somewhere in this bracket when comparing your characteristics.

- Keep everything centred on the July 1 valuation date, avoid mixing in sales far before or far after unless you time adjust.

- Use plain language, short headings, and numbered exhibits, clarity helps more than volume.

Top 5 Things to Know About What Is the Best Evidence to Protest Property Taxes in BC?

Quick checklist to keep in mind when dealing with What Is the Best Evidence to Protest Property Taxes in BC?.

- Comparable sales win, choose recent, nearby, and similar properties, tie them to July 1.

- MLS Listing sheets, include the full sheets for each comparable, they carry more weight than summaries.

- Your Property Record Card with Internal Notes, Get Your BC Assessment Property Record Card and correct errors before they inflate your value.

- Condition proof matters, photos and appraisals dated on or close to October 31 support your position.

- Stay objective, panels respond to facts, not opinions, keep adjustments reasonable and well explained.

Special cases that need extra care

Rural, unique, and waterfront properties often have few nearby sales. Thin data can create wide model estimates, disciplined evidence closes that gap. When sales are limited, expand the search radius carefully, favour the most similar properties, and explain every choice you made.

FOI packages and supporting documents

Freedom of Information packages can provide assessor notes and supporting sales, which help you understand how your property was valued. If you plan to reference FOI, keep it organized and focus on the items that directly affect market value. You can also review materials like The FOI Evidence Locker for guidance.

From the BC Property Tax Search Article Series

Learn about each stage of the BC property assessment appeal system:

- The Assessor: BC Assessment Appeals Process

- Appeal Round 1 - The Panel: Property Assessment Review Panel (PARP)

- Appeal Round 2 - The Board: Property Assessment Appeal Board of BC (PAAB)

What Is the Best Evidence to Protest Property Taxes in BC? FAQ

What counts most at a BC Assessment hearing?

Do I need a professional appraisal?

How do I get my BC Assessment Property Record Card with Internal Notes?

What if there are few comparable sales in my area?

Trusted by BC Homeowners Province Wide

I was voted Best Real Estate Agent by Cowichan Valley Citizen Readers’ Choice and featured on the front page of the Times Colonist. I earn consistent 5 star Google reviews, and my results include more than $20M in reductions, over $100k in refunds, and a 91% win rate. Learn more about me or see my BC Assessment Appeals results.

Unlock your BC Assessment Property Record Card with Internal Notes now

The fastest path to a strong appeal is confirming what BC Assessment has on file. Correcting errors in your PRC can strengthen your case and help align assessed values with your actual market value in your neighbourhood.

What you’ll learn

- How to request your PRC with internal notes

Categories

- All Blogs (78)

- BC Property Tax Search (10)

- Cost of Living on Vancouver Island (2)

- Living on Vancouver Island (26)

- Most Affordable Communities in Campbell River (1)

- Most Affordable Communities in Nanaimo (1)

- Most Affordable Communities in Parksville and Qualicum (1)

- Most Affordable Communities in the Comox Valley (1)

- Most Affordable Communities in the Cowichan Valley (1)

- Most Affordable Communities in the North Island (1)

- Most Affordable Communities in the Surrounding Islands (1)

- Most Affordable Communities on Vancouver Island (1)

- Most Expensive Communities in Campbell River (1)

- Most Expensive Communities in Nanaimo (1)

- Most Expensive Communities in Parksville and Qualicum (1)

- Most Expensive Communities in the Comox Valley (1)

- Most Expensive Communities in the Cowichan Valley (1)

- Most Expensive Communities in the North Island (1)

- Most Expensive Communities in the Port Alberni Area (2)

- Most Expensive Communities in the Surrounding Islands (1)

- Most Expensive Communities on Vancouver Island (1)

- People’s Choice Awards (10)

- Real Estate Market Guide (6)

- Vancouver Island Real Estate Market Reports (3)

- Youbou Real Estate Market Reports (3)

Recent Posts

Thinking About Selling or Buying?

Market conditions change quickly and what looks like a sellers’ market today may balance out in the months ahead. If you are planning to sell your home or purchase a property, having the right data and strategy at the right time is key.

I provide custom Market Movement reports and strategy sessions so you understand exactly where your property stands before making your next move. Connect with me below to get started.