BC Assessment Appeal Deadlines and What Happens If You Miss Them

Every January, BC Assessment mails out property assessment notices across British Columbia. Alongside the value printed on your notice is a critical piece of information: the deadline to file an appeal. Miss that date, and your opportunity to challenge your assessment is gone until the next year.

When Is the Deadline?

The official deadline to file an appeal with the Property Assessment Review Panel (PARP) is January 31 of each year. This deadline is fixed in law and does not move, even if your notice arrives late in the mail or you are away from home.

Your appeal must be filed by 11:59 PM on January 31. Submissions received after that date are almost always rejected, regardless of your reason.

How to File Before the Deadline

There are several ways to file an appeal:

- Online through BC Assessment’s appeal portal

- By fax or mail, postmarked no later than January 31

- In person at a BC Assessment office before close of business

The key is to file something on time, even a simple one line statement such as “I believe my assessment is too high.” You can add evidence later, but you cannot re open the door if you miss the filing deadline.

What Happens If You Miss the Deadline?

If you do not file by January 31, your assessed value becomes final for that year. You will be required to pay property taxes based on that assessment, even if the value is wrong.

BC law provides very limited circumstances where the Assessment Appeal Board can allow a late appeal, usually only in cases of clerical error, incorrect ownership, or situations where BC Assessment agrees the roll was wrong. These exceptions are rare and should not be relied upon.

For most homeowners, missing the deadline means waiting an entire year before you can challenge your value again.

Why This Deadline Matters

Your property assessment sets the foundation for your property taxes. A difference of even five to ten percent can translate into thousands of dollars in extra taxes over time. Missing the deadline locks in that number, even if you later find errors in your Property Record Card or discover that comparable homes were assessed much lower.

Best Practices for Homeowners

- Mark January 31 on your calendar every year

- Request your Property Record Card with Internal Notes in early January so you can see how your value was calculated

- File a protective appeal if you are uncertain, then gather evidence before your hearing

- Keep a copy of your assessment notice and appeal confirmation for your records

From the BC Property Tax Search series

Final Word

Deadlines drive the BC Assessment appeal system. Once January 31 passes, your options shrink dramatically. Protect yourself by filing early, requesting your records, and keeping track of changes year to year.

👉 Download the free PRC FOI template to request your Property Record Card with Internal Notes, and be ready before the deadline hits.

Categories

- All Blogs (78)

- BC Property Tax Search (10)

- Cost of Living on Vancouver Island (2)

- Living on Vancouver Island (26)

- Most Affordable Communities in Campbell River (1)

- Most Affordable Communities in Nanaimo (1)

- Most Affordable Communities in Parksville and Qualicum (1)

- Most Affordable Communities in the Comox Valley (1)

- Most Affordable Communities in the Cowichan Valley (1)

- Most Affordable Communities in the North Island (1)

- Most Affordable Communities in the Surrounding Islands (1)

- Most Affordable Communities on Vancouver Island (1)

- Most Expensive Communities in Campbell River (1)

- Most Expensive Communities in Nanaimo (1)

- Most Expensive Communities in Parksville and Qualicum (1)

- Most Expensive Communities in the Comox Valley (1)

- Most Expensive Communities in the Cowichan Valley (1)

- Most Expensive Communities in the North Island (1)

- Most Expensive Communities in the Port Alberni Area (2)

- Most Expensive Communities in the Surrounding Islands (1)

- Most Expensive Communities on Vancouver Island (1)

- People’s Choice Awards (10)

- Real Estate Market Guide (6)

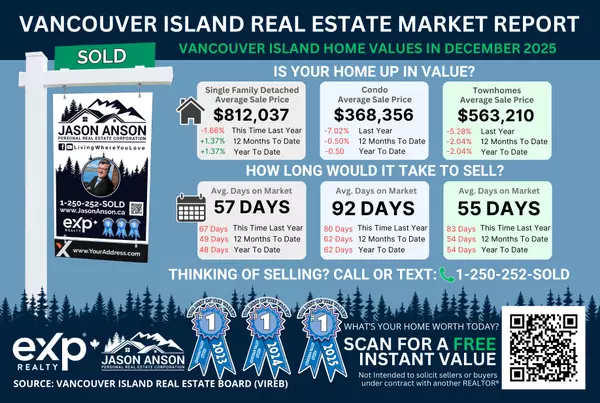

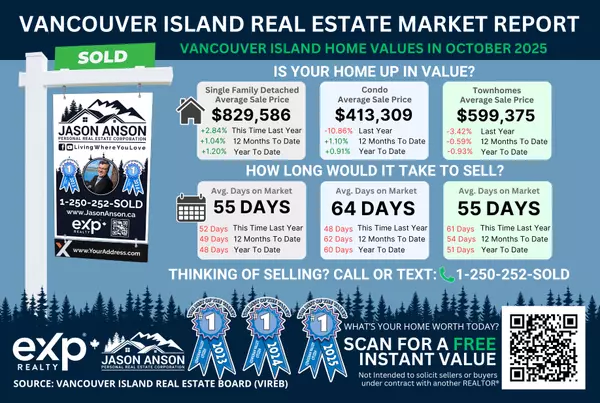

- Vancouver Island Real Estate Market Reports (3)

- Youbou Real Estate Market Reports (3)

Recent Posts

Thinking About Selling or Buying?

Market conditions change quickly and what looks like a sellers’ market today may balance out in the months ahead. If you are planning to sell your home or purchase a property, having the right data and strategy at the right time is key.

I provide custom Market Movement reports and strategy sessions so you understand exactly where your property stands before making your next move. Connect with me below to get started.