BC Assessment vs. Actual Market Value: Why They’re Different

Every January, BC Assessment sends out property assessment notices to homeowners across British Columbia. These notices set the official assessed value of your property on the assessment roll, which your municipality uses to calculate annual property taxes.

It is one of the most visited public resources on google, with homeowners, buyers, sellers, and real estate professionals using it daily as a benchmark for property values.

One of the most common questions I hear is: “Is this what my home is actually worth?” Many people, including real estate agents, will say that BC Assessment and the real estate market operate on different timelines and for different purposes. While there is some truth to that, my experience shows there is more to the story. Understanding it can mean the difference between paying a fair tax bill and paying thousands more than you should.

How BC Assessment Determines Value

BC Assessment’s mandate is to produce a uniform taxable value for every property in the province. This is done for the purposes of property taxation, not for private sale.

Valuations are based on the valuation date of July 1 from the previous year, using a mass appraisal system. The system relies on arms length sales, land and improvements data, property classifications such as residential or commercial, and statistical modeling to assign values across entire assessment areas.

In the appeal process, a sale that occurs up to six months before or after July 1 can still be time adjusted to align with the valuation date. Time adjustments, expressed as a time adjustment rate, can increase or decrease a sale price to reflect what BC Assessment believes it would have sold for on July 1.

In a flat market, adjustments may not be needed at all. This means a February sale and a July 1 sale can be treated as equally relevant.

The Margin of Error and Why It Matters

The Property Assessment Appeal Board often accepts a margin of error of plus or minus five percent as reasonable when comparing market value to assessed value.

For example, if you bought a home for $1,000,000 on July 1, an assessed value between $950,000 and $1,050,000 would likely be upheld as fair and equitable.

However, I have seen BC Assessment valuations with differences of 15 to 30%, which is far beyond the acceptable range. That gap is not just academic. It can translate into thousands of dollars in extra property tax every year.

Mass Appraisal vs. Comparative Market Analysis (CMA)

The mass appraisal methodology used by BC Assessment is very different from a Comparative Market Analysis prepared by a licensed REALTOR or a narrative appraisal prepared by an accredited appraiser.

Mass appraisal groups properties into broad categories based on location, lot size, building age, and quality class. This method often overlooks unique features, renovations, or defects that can significantly influence value.

When a homeowner files an assessment appeal, BC Assessment switches from mass appraisal to using hand selected comparable sales to defend the value. These may not have been part of the original model. This can lead to sales chasing, where the Assessor selects evidence after the fact to justify the existing value.

MLS® Pending Date vs. Sold Date

When establishing market value for an appeal, the most important date is the pending date, also called the contract date. This is the day when all subjects are removed and both parties are bound to the price.

This is different from the completion date or registration date, when the property actually changes hands.

Why does this matter? A pending date that is close to July 1 is far more relevant to BC Assessment’s valuation than a sale that completed months later. Sometimes, BC Assessment’s internal records do not clearly distinguish these dates, and correcting this can change the outcome of an appeal.

The Impact of Data Quality on Assessments

Accurate inventory data is essential to accurate assessments. In 2023, a BC Assessment whistleblower revealed major issues when transferring property records from the Land Title and Survey Authority into the new iAS World assessment database.

These data errors included phantom basements, extra bedrooms, and incorrect finished floor area. Because the mass appraisal system uses this data for modeling, errors can directly lead to inflated or deflated assessed values.

Even when homeowners report errors, I have seen them remain in place for years. In many cases, corrections require approval from a BC Assessment appraiser instead of a data clerk, which slows down the process.

Common Mistakes Homeowners Make

- Assuming the BC Assessment value is always far from market value

In many cases, BC Assessment values can be brought very close to market value through time adjustments. The idea that they are always “out of sync” is oversimplified and can cause people to overlook valid opportunities in the assessment appeal process.

- Using the wrong sales data

Relying on sold dates instead of pending dates, or selecting sales from markets that are not truly comparable, can weaken your case. Effective appeals rely on accurate comparable sales analysis, just like a real estate appraisal or market analysis performed by a professional.

- Not challenging obvious inventory errors

A wrong bedroom count, incorrect finished floor area, or an inaccurate land size can significantly affect value. Many homeowners never review their BC Assessment record or the tax roll for mistakes.

- Missing the appeal deadline

The deadline to file a BC property tax assessment appeal is January 31. If you miss it, your opportunity for review is gone until the next year.

Tips and Best Practices for BC Homeowners

- Request your Property Record Card (PRC) through a BC Assessment FOI request to see the exact details used to value your home and compare them to the official assessment roll.

- Compare the market movement in your neighbourhood between your pending date and July 1, and consider having a real estate appraisal or professional market analysis done to confirm value.

- If your assessed value is off by more than 5 percent from actual market value, your appeal may be stronger.

- Pay attention to micro-neighbourhood differences. The mass appraisal system may lump you into a larger zone that does not reflect your property’s specific advantages or disadvantages.

- Always review your assessment each January, even in flat markets, because inventory errors or inappropriate sales comparables can occur in any year.

From the BC Property Tax Search series

BC Assessment plays an important role in funding local services through BC property taxes, but its mass appraisal system is not a precise measure of what your property would sell for today. From my experience, the accuracy of an assessment can vary widely, sometimes within the acceptable plus or minus 5 percent range, but often by 15 to 30 percent.

Understanding how BC Assessment calculates value, the difference between pending and sold dates, the role of the official tax roll, and the impact of inventory errors can help you make informed decisions about whether to start the assessment appeal process.

From my perspective, BC Assessment is a taxation tool, not a real estate appraisal or a detailed market analysis. Its accuracy can vary more than most people realize. If you want to know what your home is worth in today’s market, based on current conditions, comparable sales, and accurate property details, it helps to get a professional evaluation from someone who understands both the assessment system and your local market.

Categories

- All Blogs (78)

- BC Property Tax Search (10)

- Cost of Living on Vancouver Island (2)

- Living on Vancouver Island (26)

- Most Affordable Communities in Campbell River (1)

- Most Affordable Communities in Nanaimo (1)

- Most Affordable Communities in Parksville and Qualicum (1)

- Most Affordable Communities in the Comox Valley (1)

- Most Affordable Communities in the Cowichan Valley (1)

- Most Affordable Communities in the North Island (1)

- Most Affordable Communities in the Surrounding Islands (1)

- Most Affordable Communities on Vancouver Island (1)

- Most Expensive Communities in Campbell River (1)

- Most Expensive Communities in Nanaimo (1)

- Most Expensive Communities in Parksville and Qualicum (1)

- Most Expensive Communities in the Comox Valley (1)

- Most Expensive Communities in the Cowichan Valley (1)

- Most Expensive Communities in the North Island (1)

- Most Expensive Communities in the Port Alberni Area (2)

- Most Expensive Communities in the Surrounding Islands (1)

- Most Expensive Communities on Vancouver Island (1)

- People’s Choice Awards (10)

- Real Estate Market Guide (6)

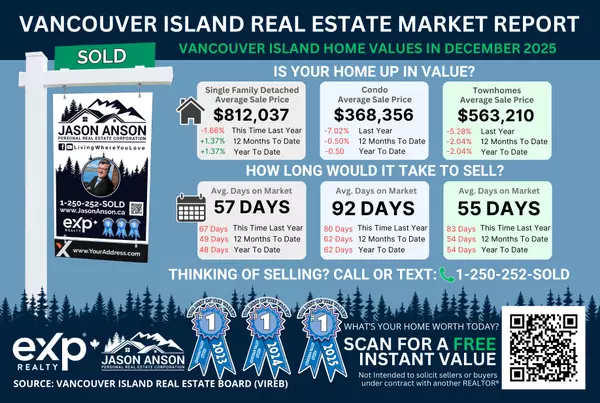

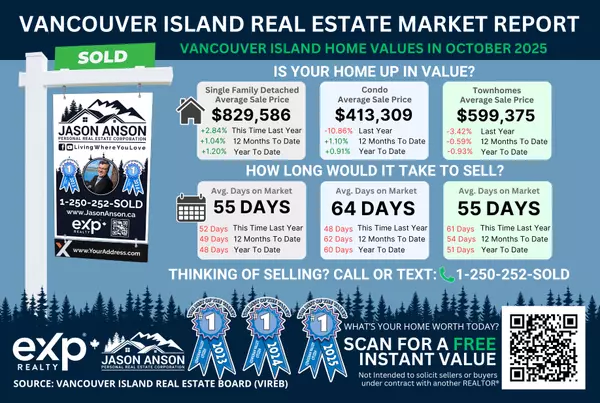

- Vancouver Island Real Estate Market Reports (3)

- Youbou Real Estate Market Reports (3)

Recent Posts

Thinking About Selling or Buying?

Market conditions change quickly and what looks like a sellers’ market today may balance out in the months ahead. If you are planning to sell your home or purchase a property, having the right data and strategy at the right time is key.

I provide custom Market Movement reports and strategy sessions so you understand exactly where your property stands before making your next move. Connect with me below to get started.