Common Mistakes Homeowners Make When Appealing Their BC Assessment

Appealing your BC Assessment can save you thousands in property taxes, but only if you approach it with the right strategy. Too many homeowners rush into an appeal, rely on assumptions, or trust BC Assessment’s process to work in their favour and that often leads to costly mistakes. Based on real appeal experience, here are the biggest errors to avoid.

Missing the January 31 Deadline

The appeal filing deadline is almost always January 31. In rare cases, such as leap years or if the date falls on a weekend, the deadline might shift by a day, but there is no real leniency. The Board has made it clear: missing this date ends your right to appeal for the year. Excuses like being out of the country have been rejected unless there are extraordinary circumstances. You can miss interim steps in the appeal process and recover, but never this one.

Misunderstanding the Basis for Appeal

Appeals must be tied to the legislated grounds: actual market value as of July 1 of the previous year, errors in property description, or classification mistakes. Without aligning your argument to these grounds, your appeal will fail before it starts.

Relying on BC Assessment As a Source For Evidence

Many homeowners depend on BC Assessment to provide complete and fair comparable sales. In reality, my internal audits have shown that 20-25% of MLS sales may be omitted from their public website. BC Assessment will give various reasons, but some omissions have no clear justification. Always gather your own MLS comparables and obtain your Property Record Card to check for missing or inaccurate data.

Using Comparables Without Bracketing

The problem is rarely picking the wrong comparables, it’s not knowing how to bracket them. Panels and the Board look for a qualitative approach: is a comparable superior, inferior, or similar? Establish a range, then show where your property fits. Quantitative “add and subtract” adjustments for garages, views, or decks are less persuasive in property assessment appeals.

Overpreparing for the Property Assessment Review Panel (PARP / The Panel)

The Property Assessment Review Panel only gives you about six minutes to present your case. Homeowners often spend 100+ hours preparing, but the panel process is designed to filter cases before the Board. The BC Assessment evidence and presenters at the panel may be entirely different at the Board stage. Focus your energy on building a Board-ready case rather than over-investing in the Panel.

From the BC Property Tax Search series

Winning an appeal means meeting the January 31 deadline, knowing the legislated grounds, gathering your own evidence, bracketing comparables effectively, and preparing for the process beyond the panel. Avoid these traps, and you’ll dramatically improve your chances of a fair outcome.

Categories

- All Blogs (78)

- BC Property Tax Search (10)

- Cost of Living on Vancouver Island (2)

- Living on Vancouver Island (26)

- Most Affordable Communities in Campbell River (1)

- Most Affordable Communities in Nanaimo (1)

- Most Affordable Communities in Parksville and Qualicum (1)

- Most Affordable Communities in the Comox Valley (1)

- Most Affordable Communities in the Cowichan Valley (1)

- Most Affordable Communities in the North Island (1)

- Most Affordable Communities in the Surrounding Islands (1)

- Most Affordable Communities on Vancouver Island (1)

- Most Expensive Communities in Campbell River (1)

- Most Expensive Communities in Nanaimo (1)

- Most Expensive Communities in Parksville and Qualicum (1)

- Most Expensive Communities in the Comox Valley (1)

- Most Expensive Communities in the Cowichan Valley (1)

- Most Expensive Communities in the North Island (1)

- Most Expensive Communities in the Port Alberni Area (2)

- Most Expensive Communities in the Surrounding Islands (1)

- Most Expensive Communities on Vancouver Island (1)

- People’s Choice Awards (10)

- Real Estate Market Guide (6)

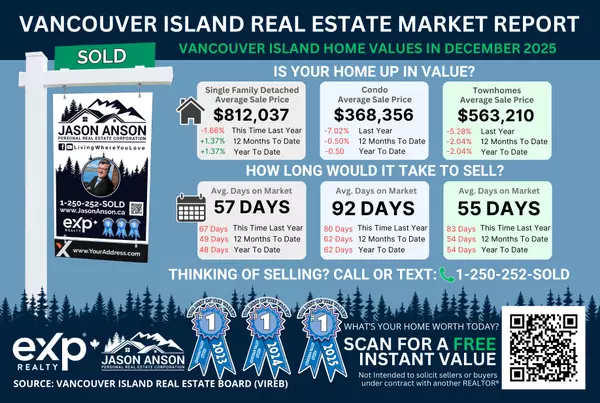

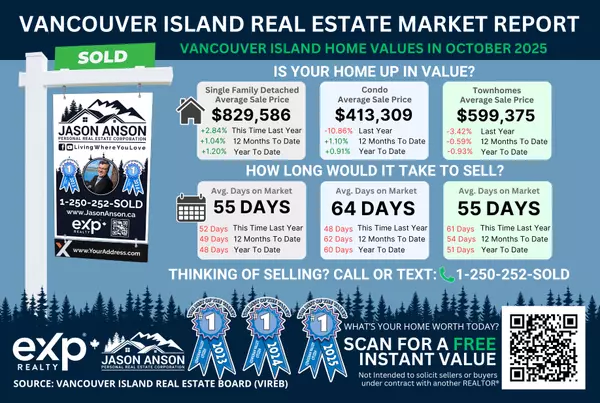

- Vancouver Island Real Estate Market Reports (3)

- Youbou Real Estate Market Reports (3)

Recent Posts

Thinking About Selling or Buying?

Market conditions change quickly and what looks like a sellers’ market today may balance out in the months ahead. If you are planning to sell your home or purchase a property, having the right data and strategy at the right time is key.

I provide custom Market Movement reports and strategy sessions so you understand exactly where your property stands before making your next move. Connect with me below to get started.