In March 2024, Vancouver Island waterfront home values experienced notable shifts, reflecting broader economic and local market dynamics. This report meticulously analyses data from the Vancouver Island Real Estate Board, providing homeowners, potential buyers, and investors with critical insights into current market trends and future outlooks.

Economic Conditions:

The Bank of Canada’s latest report indicates a stable economic environment with interest rates maintained to encourage investment, directly impacting real estate market liquidity and borrowing costs.

Supply and Demand:

March 2024 has shown a vibrant activity in the Vancouver Island waterfront home market. Listings increased significantly by 58.14% compared to last year, with 68 units listed this month. Despite a slight decrease in units sold year-over-year from 45 to 44, the market’s resilience is evident from the continued interest and competitive pricing.

Vancouver Island Real Estate Market Overview for March 2024:

This month’s real estate market on Vancouver Island displays a robust uptick in activity, especially in waterfront properties. With an increase in units listed and a competitive sell/list ratio of 38.24%, the market is leaning towards a sellers’ advantage. Economic stability and appealing mortgage rates are pivotal factors this season.

Detailed Analysis:

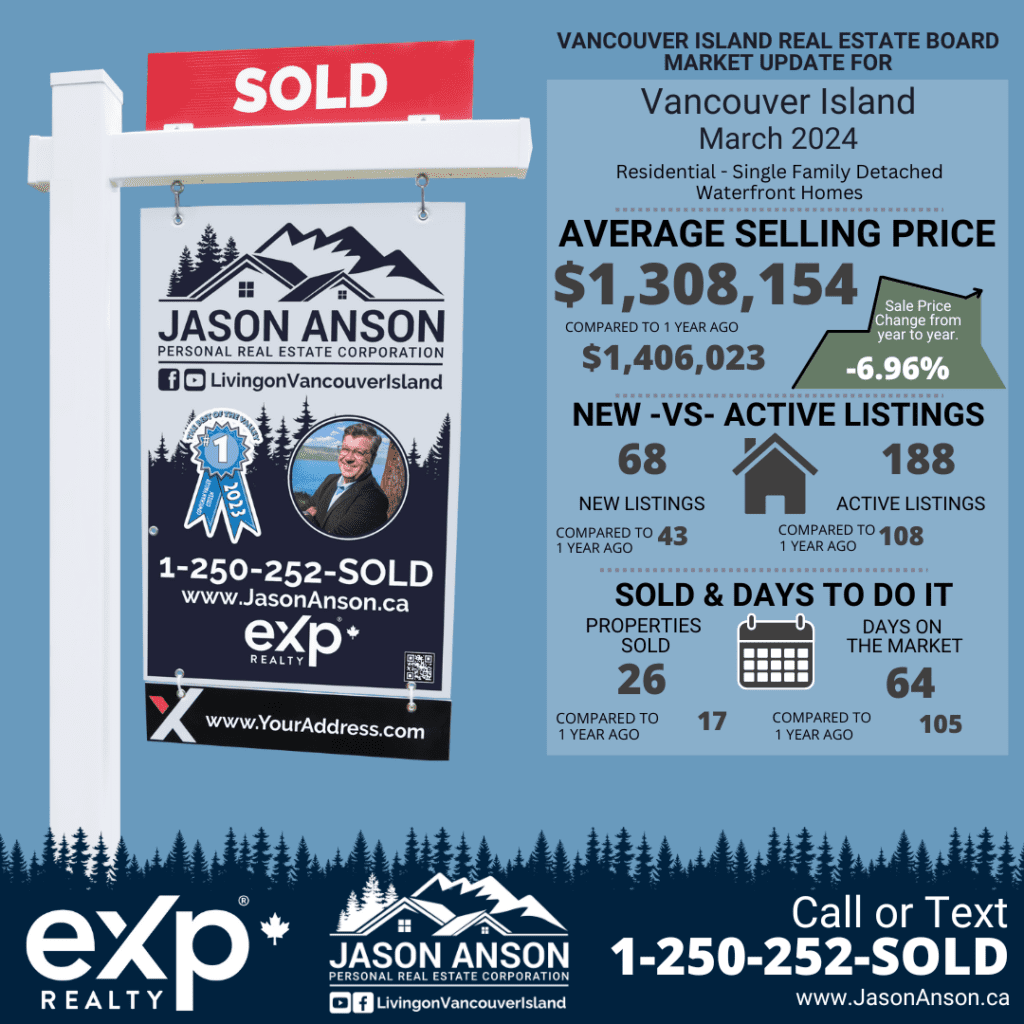

March 2024 saw a total of 26 waterfront homes sold on Vancouver Island, marking a 52.94% increase in units reported sold compared to last year. However, the average sell price per unit has slightly decreased by 6.96%, settling at $1,308,154, indicating a slight adjustment in market valuation that could appeal to new buyers.

Vancouver Island Real Estate Market Insight: Comparative Activity by Residential – Single Family Detached (Waterfront) for March 2024:

- Units Listed: There was a sharp increase in listings, up by 58.14% from last year, signaling a robust influx of properties into the market.

- Units Reported Sold: Sales saw a boost, with a 52.94% increase compared to last year, reflecting sustained buyer interest.

- Sell / List Ratio: The ratio slightly decreased, suggesting a slightly more competitive market for sellers.

- Reported Sales Dollars: Sales volume increased by 42.30% to $34,012,000.

- Average Sell Price / Unit: Decreased to $1,308,154, possibly affecting buyer decisions.

- Median Sell Price: Settled at $1,225,000 for this period.

- Sell Price / List Price Ratio: Improved to 98.39%, indicating close to full price offers are common.

- Days to Sell: Decreased significantly by 39.05% to 64 days, showing a faster-moving market.

- Active Listings: Increased to 188, providing more options for buyers.

Current Month Analysis:

March 2024 presented a dynamic waterfront housing market with increased listings and robust sales. The quicker sales times and high sell price/list price ratio reflect a healthy market, but the average sell price per unit’s slight dip could indicate a shift towards buyer favorability.

12 Months to Date Analysis:

Over the past year, Vancouver Island’s waterfront market has seen a steady increase in activity, with sales numbers slightly up by 4.46%. The consistent sell/list ratio above 34% across the year demonstrates market stability.

Year to Date Analysis:

The year-to-date metrics continue to impress with a 66.67% increase in listings, though sales have slightly dipped. The market’s depth and liquidity are healthy, supported by a consistent influx of new listings.

Impact on Buyers:

The current market scenario suggests a buyer-friendly environment might be developing, with average prices slightly decreasing. Buyers might find this a favorable time to invest, given the improved sell/list ratios and reduced days to sell.

Impact on Sellers:

Sellers are seeing a fast-moving market with good return on listings prices. The slight decrease in average sell prices should be monitored, but the market remains favorable for sellers looking to capitalize on the high interest in waterfront properties.

Market Sentiment:

As we conclude, Vancouver Island’s waterfront home market in March 2024 shows promising signs of both stability and activity. With increased listings and robust sales, the market dynamics suggest a healthy balance, making it an opportune time for both buying and selling. For tailored insights and strategies, potential market participants are encouraged to engage with local experts.

🔍 Seeking market insights? Discover how trends can benefit you!

🏠 Thinking of Buying or Selling?

📲 Call or Text: 1-250-252-SOLD

For Expert Advice, visit https://jasonanson.ca/book-a-call/.