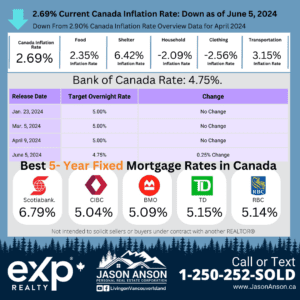

On June 5, 2024, the Bank of Canada announced a .25 basis point reduction in its benchmark interest rate, bringing it down to 4.75 per cent. This is the first rate cut in over four years and presents a significant opportunity for homebuyers and investors in the Vancouver Island real estate market.

The rate cut was driven by progress in reducing inflation, weaker-than-expected economic growth in the first quarter, and slower employment growth compared to the working-age population. As a result, the central bank decided that monetary policy no longer needed to be as restrictive.

The lower interest rates translate into reduced mortgage payments, allowing buyers to get more value for their money. This is particularly beneficial for first-time homebuyers who might have been previously priced out of the market. Additionally, current homeowners might find it advantageous to refinance their mortgages at the new lower rates, reducing their monthly payments or paying off their loans faster.

Recent data has increased our confidence that inflation will continue to move towards the 2 per cent target,” the Bank of Canada noted. This confidence in a stable economic environment further supports the decision to make borrowing more accessible.

For those considering selling their property, the rate cut could lead to increased demand as more buyers enter the market, potentially driving up property values.

Overall, the Bank of Canada’s interest rate cut is poised to have a positive impact on the Vancouver Island real estate market, making it a great time for buyers and sellers alike to take advantage of the new financial landscape. As always, it’s essential to stay informed and consult with a knowledgeable realtor to navigate the changing market conditions effectively.