Should I Appeal My BC Assessment?

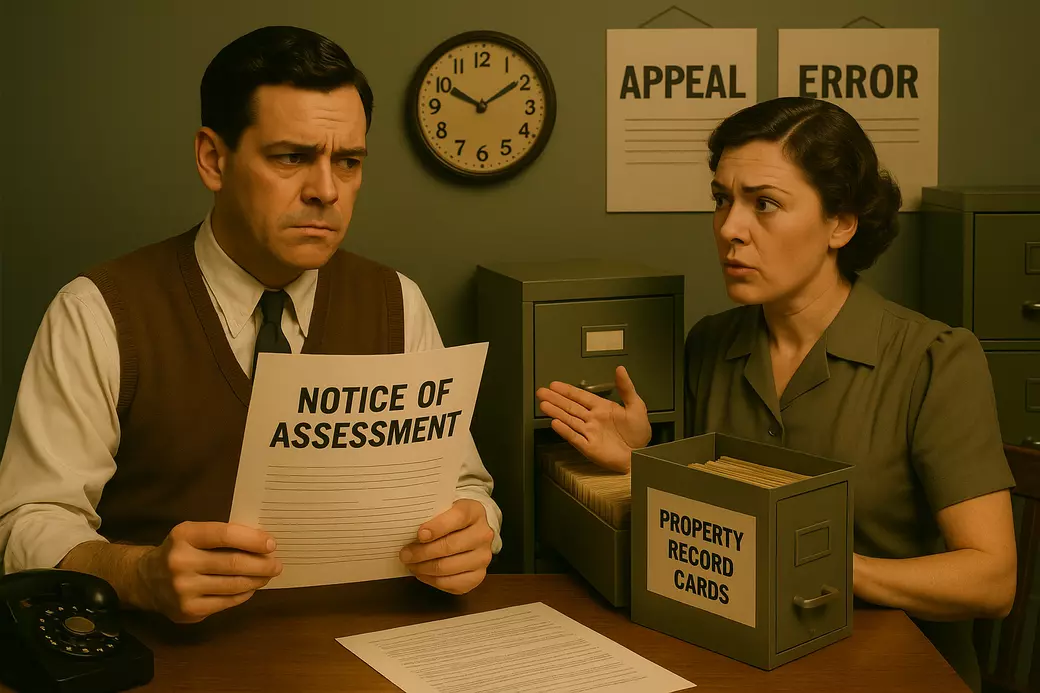

Each January, BC Assessment mails out property assessment notices that determine how much tax you will pay in the year ahead. If your assessed value seems out of line with the market or your neighbours, you may be wondering whether to file an appeal. Understanding the BC Assessment appeal process can help you decide if a challenge is worthwhile.

When to Consider a BC Assessment Appeal

The BC assessment system aims to keep values fair and consistent, but errors and discrepancies do happen. If your property’s assessed value is significantly higher than comparable homes in your neighbourhood, or if there are inaccuracies in the details used to calculate the assessment, an appeal may be appropriate. It is important to distinguish between increases due to market trends, which apply broadly, and unique errors affecting only your property.

How the Appeal Process Works

The appeal process in BC follows a structured timeline. Property owners must file a notice of complaint by January 31. This initiates a review by the independent Property Assessment Review Panel (PARP), which typically meets between February and March. If you are not satisfied with their decision, you can escalate the matter to the Property Assessment Appeal Board (PAAB) for a more formal hearing. Each stage requires evidence, such as recent sales data or documentation of errors, to support your case.

Key Reasons Homeowners Appeal

- Assessment is higher than similar properties in the area

- Incorrect property details, such as square footage or condition

- Overlooked issues like flooding, foundation problems, or location disadvantages

- Disproportionate tax impact compared to neighbours

- Belief that market value was miscalculated or outdated

Preparing for an Appeal

Before submitting an appeal, gather recent sale prices of comparable properties, review your assessment details for errors, and consider obtaining a professional appraisal. Clear, objective evidence carries far more weight than personal opinions about value. Keep in mind that if your property is undervalued, BC Assessment could adjust it upward, though this is less common.

From the BC Property Tax Search series

- BC Property Tax Mistakes to Avoid

- Understanding Your BC Property Tax Bill

- BC Property Assessment vs Market Value

For more details on the BC assessment system, appeal procedures, and provincial property rules, visit these official resources:

When is the deadline to appeal my BC Assessment?

Can my property value increase if I appeal?

What evidence should I provide in an appeal?

Does appealing my assessment reduce my taxes automatically?

If your property details look inaccurate, do not wait until it is too late. Download the free Property Record Card FOI template to check what BC Assessment has on file for your home before you decide whether to appeal.

Categories

- All Blogs (78)

- BC Property Tax Search (10)

- Cost of Living on Vancouver Island (2)

- Living on Vancouver Island (26)

- Most Affordable Communities in Campbell River (1)

- Most Affordable Communities in Nanaimo (1)

- Most Affordable Communities in Parksville and Qualicum (1)

- Most Affordable Communities in the Comox Valley (1)

- Most Affordable Communities in the Cowichan Valley (1)

- Most Affordable Communities in the North Island (1)

- Most Affordable Communities in the Surrounding Islands (1)

- Most Affordable Communities on Vancouver Island (1)

- Most Expensive Communities in Campbell River (1)

- Most Expensive Communities in Nanaimo (1)

- Most Expensive Communities in Parksville and Qualicum (1)

- Most Expensive Communities in the Comox Valley (1)

- Most Expensive Communities in the Cowichan Valley (1)

- Most Expensive Communities in the North Island (1)

- Most Expensive Communities in the Port Alberni Area (2)

- Most Expensive Communities in the Surrounding Islands (1)

- Most Expensive Communities on Vancouver Island (1)

- People’s Choice Awards (10)

- Real Estate Market Guide (6)

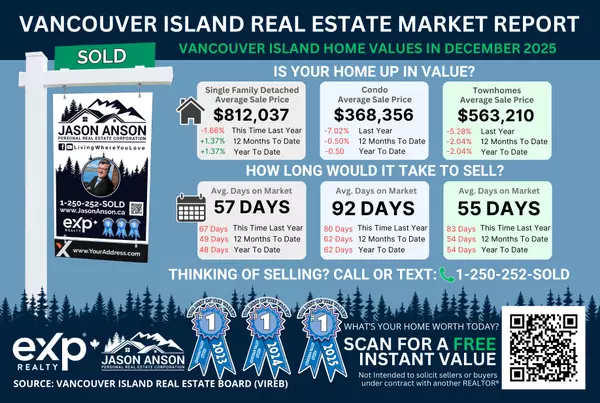

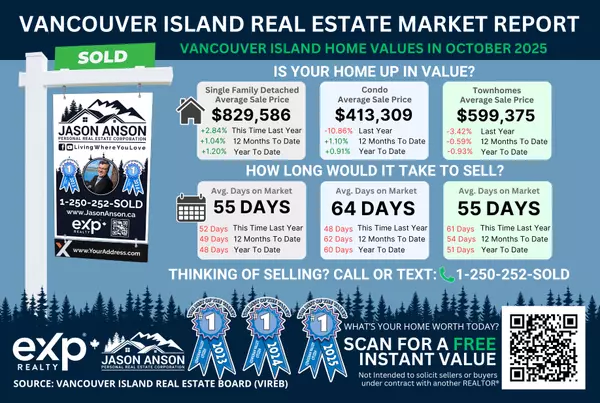

- Vancouver Island Real Estate Market Reports (3)

- Youbou Real Estate Market Reports (3)

Recent Posts

Thinking About Selling or Buying?

Market conditions change quickly and what looks like a sellers’ market today may balance out in the months ahead. If you are planning to sell your home or purchase a property, having the right data and strategy at the right time is key.

I provide custom Market Movement reports and strategy sessions so you understand exactly where your property stands before making your next move. Connect with me below to get started.